Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

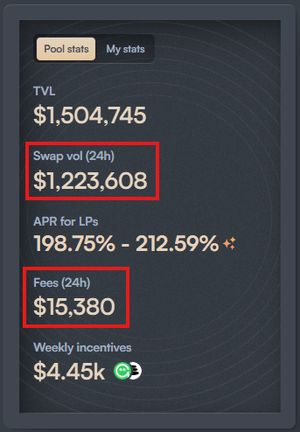

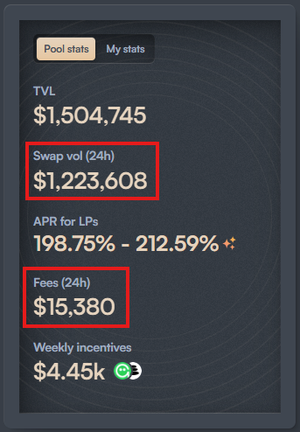

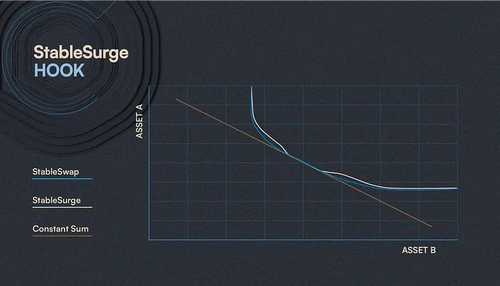

Our StableSurge hook just dominated during the increased volumes on $USDf 🔥

Lower TVL and volume but way higher fees, outperforming Uniswap and Curve 📈

This is the power of risk-adjusted rewards.

Let's compare 🧵

The metrics speak for themselves.

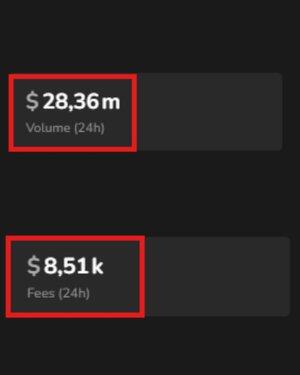

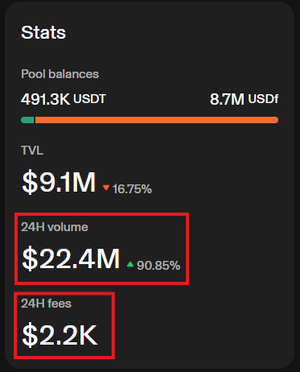

Curve’s $USDC / $USDf pool saw 23x more volume than Balancer’s $GHO / $USDf…

Yet it only generated almost half the fees.

That’s hook efficiency in action 👇

Against the Uniswap pool, the difference is even bigger.

Despite handling ~18x less volume, Balancer’s $GHO / $USDf pool managed to generate around 7x more fees than Uniswap’s $USDT / $USDf pair.

StableSurge clearly doing his job 👇

How does 15x less volume = 7x higher fees?

StableSurge's asymmetric fee scaling during imbalance ⚡

When $USDf's price deviated from the peg, the hook calculated:

surgeFee = baseFee + (maxFee - baseFee) × (imbalance - threshold) / (1 - threshold)

Destabilizing trades paid escalating fees up to maximum, while peg-restoring trades paid base rate only.

Fee scales linearly with pool deviation from target balance, creating natural arbitrage incentives while maximizing LP compensation during stress periods 🎯

31,49K

Johtavat

Rankkaus

Suosikit