Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

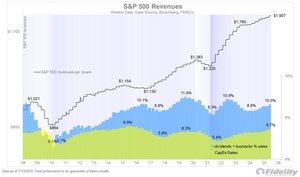

In the US, both share buybacks and capital spending have been improving, in absolute terms and as a percentage of revenues. Those revenues have continued to trend higher for the S&P 500. There appears to be nothing not to like!

The rub, of course, is that all this positive fundamental context is already priced in, with the S&P 500 index now trading at 36 times free cash flow. That’s back to the nose-bleed levels seen late last year. For the equal-weighted index the multiple is not quite as high (27x), but still near the highs of its historical range. The market is priced for success, betting on another fiscal impulse from the OBBB.

This brings me back to my question from last week. Looking only at the top panel, would you want to be long this chart? The answer is likely yes. But if you add the bottom panel to the mix, do you still want to be long this chart? That answer is likely not as easy. Starting points matter, and in terms of valuation, this is a tricky starting point.

12,05K

Johtavat

Rankkaus

Suosikit