Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

If users aren’t being paid to show up, and they still do, that’s what you call product-market fit.

We’re in a market where every protocol is launching a token, dangling points, or bootstrapping with emissions.

That makes it harder (and more important) to filter signal from noise.

This post breaks down three protocols scaling without incentives:

Base, Meteora, and Yei Finance.

Each one is quietly compounding adoption. No airdrops. No mercenaries. Just usage.

Let’s unpack why this filter matters. It might be your highest-conviction bull market screen.

● Why Most DeFi Growth Isn’t Real

There’s a pattern:

- Launch with high emissions.

- Bribe for liquidity or usage.

- Hope the market forgets when it stops.

But when incentives dry up, so does the usage.

That’s not a bug. It’s the design.

Token-led growth is a marketing tool, not a retention engine.

The question smart capital is asking now:

Who’s growing without the bribes?

● How to Spot Real Demand in a Noisy Market

Criteria:

- No token rewards

- No LP farming multipliers

- Real usage, real TVL, organic demand

Protocols that pass this filter aren’t just building.

They’re winning because their core product matters.

Here are 3 protocols doing exactly that. Scaling quietly, sustainably, and without emissions.

1. Base ( @base)

No token. No farm-and-dump flywheel.

And yet, Base is now the largest Ethereum L2 by TVL ($3.95 billion) and adding real usage at the application layer.

In the last 24h:

- Chain fees: $153K

- App fees: $2.46M

- App revenue: $908K

The kicker? All of that happened without Base token incentives.

Why does Base work?

✅ Coinbase onboarding funnel (millions of new users)

✅ DeFi-native apps like Aerodrome, Seamless protocol, and Avantis

✅ Consumer social apps (Farcaster) building sticky demand

Base isn’t growing because it’s being subsidized.

It’s growing because the on-chain UX finally feels good. And apps are building on top of that foundation.

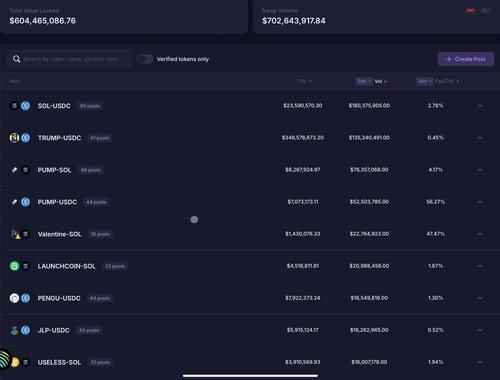

2. Meteora ( @MeteoraAG)

Solana’s TVL has returned, but the meta has shifted. It’s not just about cheap throughput anymore, it’s about composable yield infrastructure.

That’s where Meteora stands out.

TVL is climbing, usage is deepening, and fees are flowing without a token farming meta.

Meteora powers Solana’s liquidity layer through:

✅ Dynamic Vaults that auto-route capital to the best yields

✅ DLMMs (Dynamic Liquidity Market Makers) that reduce slippage and increase LP returns

✅ Bin-based AMMs that concentrate liquidity at meaningful price points

What’s striking is that most of this TVL is sticky. Users aren’t being bribed, they’re participating because the yields are structurally better.

And as Solana DeFi regains traction, Meteora is becoming the “backend liquidity engine” for much of that growth.

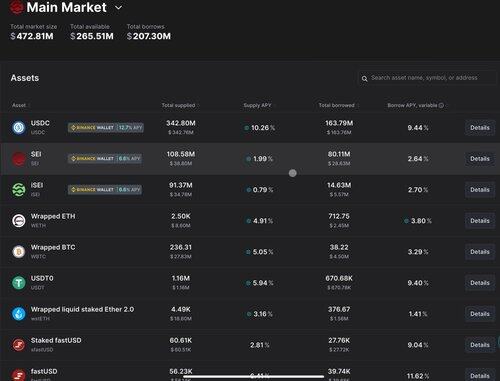

3. Yei Finance ( @YeiFinance)

Launched on Sei, Yei Finance looks like a classic money market on the surface: lend, borrow, swap.

But dig deeper and you’ll see this:

- $119M → $390M in TVL. 3x growth since January.

- $627M in active borrow volume.

- No token emissions.

That’s rare in this market.

Yei’s traction is driven by:

✅ Isolated vaults and risk parameters per asset

✅ Seamless bridging + cross-chain lending

✅ Liquid $ETH staking strategies built natively into the vaults

This is a protocol onboarding sticky DeFi users by solving actual problems. Not by issuing speculative IOUs.

Their token hasn’t launched yet, but when it does, it's likely to serve an aligned role, not a compensatory one.

● Why Tokenless Growth Is a Bull Market Filter

Bull markets flood the zone with capital.

The question is: Where do users go when no one's paying them to go anywhere?

That’s where:

- @base wins: UX and retail reach > emissions

- @MeteoraAG wins: Real yield for LPs, not just points

- @YeiFinance wins: Lending strategies users want, before incentives

In the next phase of this market, token utility will matter.

But token dependency? That’s a red flag.

If a protocol can scale before incentives kick in, it’s positioned to run when they do.

These aren’t just bets on tech.

They’re bets on traction that wasn’t bought.

16,69K

Johtavat

Rankkaus

Suosikit