Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Claiming that "banks will buy $ETH to secure their stablecoins" is like claiming that people will buy muni bonds because they enjoy using the playground at their local park.

(Not an Ethereum bash, it's a Tom Lee selling rube slop bash)

3.7. klo 01.21

🇺🇸 LATEST: Tom Lee predicts banks will buy $ETH to secure their stablecoins, not just for speculation, but for infrastructure.

Zero slop required.

Chainlink sells many, many services that TradFi and DeFi will happily pay for, which get converted into LINK.

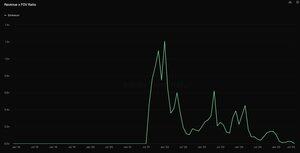

The reason he has to sell Mother Goose story hour slop is because the Ethereum revenue chart is going to zero.

Revenue from services > Mother Goose story hour slop for rubes

27.7. klo 18.47

The thesis of Chainlink is completely different today than its early years.

How it started: A single data oracle service

How it's going: The Web3 cloud powering entire apps

Chainlink started out simple, providing existing data on to blockchains. Onchain apps used that data to make decisions like whether to liquidate a loan or how to settle a perp.

Chainlink then expanded into different types of computation (e.g., random number generation, keeper automation) before launching its cross-chain protocol. However, those were only building blocks to a much, much bigger value proposition emerging.

With the introduction of the Chainlink Runtime Environment (CRE), Chainlink is primed to be the main way developers and institutions both build onchain apps and power them through their lifecycle.

Chainlink is no longer just a service or even set of services, but the foundation underpinning onchain apps and use cases. It’s akin to the cloud but decentralized and for onchain apps, providing them the development framework for building apps, the key services they require, and the computation that powers them on the backend.

But why is this important? And why is Chainlink doing this?

The blockchain landscape is changing. You used to use a single blockchain as your cloud-like environment. But now there are hundreds of chains and you want to be able to interact across them all. Transactions are also more complex with the introduction of tokenized real-world assets (RWAs). This is the phenomenon of all the world’s existing value becoming tokenized, which is 100x the value that currently exists onchain. Thus, you must adopt RWAs if you want to succeed in this industry long term at any scale.

However, the introduction of RWAs requires new services. They require data like DeFi, but even more types of data, such as proof of reserves, net asset value, and much more. They also require compliance policies built into the asset itself and the services transacting them, which naturally needs identity data to work. Furthermore, they need privacy features, connectivity across chains, and integrations with legacy systems.

The best way to build an app like this is through a single platform that is chain-agnostic and has all the key services already built-in. This is Chainlink.

Chainlink is the only all in one platform where institutions can solve all their data, cross-chain, compliance/identity, privacy, and legacy system integration requirements. And importantly, they can combine these service into one sequential workflow (i.e., one piece of code) that Chainlink runs securely end-to-end in a decentralized manner.

This workflow is essentially an app that interacts seamlessly across chains and legacy systems while leveraging key services along its lifecycle. Once you build this workflow, you can easily reuse it and modify it to support new customers, new chains, new legacy systems, new oracle data, new use cases, etc without rewriting it all. It’s by far the most efficient and future-proof way to not only build DeFi apps, but apps for tokenized RWAs, which are the future of our industry.

This value prop puts Chainlink at the heart of onchain applications; far beyond just being a side service. The market doesn’t quite understand yet how well Chainlink is positioned, but it will because its product offering, vision, and historical track record of delivering solutions meshes perfectly with where the industry is heading and what TradFi & DeFi require to succeed in this new RWA paradigm.

I'm working on a thread that will cover a lot of other angles, but this attached post captures a lot.

1. Chainlink has more services to sell than any other protocol.

2. .Chainlink’s new architecture (CRE) changes entire process of how app development is anchored and sequenced from:

Old way: Choose chain first -> Build on-chain app next -> choose bridge/oracle at end

New way: Choose Chainlink platform first -> build all of your workflows inside CRE -> Deploy your chain-agnostic workflows onto every single chain you want to be on.

“Build Once, Run Everywhere”

The entire dichotomy of guessing which chain will “win” is obsolete; trivial to deploy your workflows across all of them.

Aave is live on 20 chains. Think of the implications around network effects, value accrual, dispersion of asset issuance, how ecosystem growth will be assessed, etc.

27.7. klo 18.47

The thesis of Chainlink is completely different today than its early years.

How it started: A single data oracle service

How it's going: The Web3 cloud powering entire apps

Chainlink started out simple, providing existing data on to blockchains. Onchain apps used that data to make decisions like whether to liquidate a loan or how to settle a perp.

Chainlink then expanded into different types of computation (e.g., random number generation, keeper automation) before launching its cross-chain protocol. However, those were only building blocks to a much, much bigger value proposition emerging.

With the introduction of the Chainlink Runtime Environment (CRE), Chainlink is primed to be the main way developers and institutions both build onchain apps and power them through their lifecycle.

Chainlink is no longer just a service or even set of services, but the foundation underpinning onchain apps and use cases. It’s akin to the cloud but decentralized and for onchain apps, providing them the development framework for building apps, the key services they require, and the computation that powers them on the backend.

But why is this important? And why is Chainlink doing this?

The blockchain landscape is changing. You used to use a single blockchain as your cloud-like environment. But now there are hundreds of chains and you want to be able to interact across them all. Transactions are also more complex with the introduction of tokenized real-world assets (RWAs). This is the phenomenon of all the world’s existing value becoming tokenized, which is 100x the value that currently exists onchain. Thus, you must adopt RWAs if you want to succeed in this industry long term at any scale.

However, the introduction of RWAs requires new services. They require data like DeFi, but even more types of data, such as proof of reserves, net asset value, and much more. They also require compliance policies built into the asset itself and the services transacting them, which naturally needs identity data to work. Furthermore, they need privacy features, connectivity across chains, and integrations with legacy systems.

The best way to build an app like this is through a single platform that is chain-agnostic and has all the key services already built-in. This is Chainlink.

Chainlink is the only all in one platform where institutions can solve all their data, cross-chain, compliance/identity, privacy, and legacy system integration requirements. And importantly, they can combine these service into one sequential workflow (i.e., one piece of code) that Chainlink runs securely end-to-end in a decentralized manner.

This workflow is essentially an app that interacts seamlessly across chains and legacy systems while leveraging key services along its lifecycle. Once you build this workflow, you can easily reuse it and modify it to support new customers, new chains, new legacy systems, new oracle data, new use cases, etc without rewriting it all. It’s by far the most efficient and future-proof way to not only build DeFi apps, but apps for tokenized RWAs, which are the future of our industry.

This value prop puts Chainlink at the heart of onchain applications; far beyond just being a side service. The market doesn’t quite understand yet how well Chainlink is positioned, but it will because its product offering, vision, and historical track record of delivering solutions meshes perfectly with where the industry is heading and what TradFi & DeFi require to succeed in this new RWA paradigm.

Imagine my shock that the protocols who have no fees say fees aren't important. It doesn't mean fees aren't important. It means look for the protocol that will have fees. The fat protocol thesis fried everyone's brains.

>fees are extractive

Fees are the intersection of the supply and demand curves. They are how capitalism works. Do you tell your grocery store cashier how the $5 you paid for a quart of milk was "extractive?"

>race to the bottom

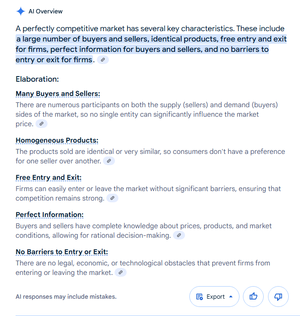

See my attached post about "race to the bottom." Protocols competing in perfectly competitive markets will "race to the bottom."

2.6.2025

Why will fees continue converging towards zero? Because most of these protocols are competing in what's known in economic terms as a "perfectly competitive market."

Look at the below image that describes the needed attributes for a market to be considered a "perfectly competitive market"

>Many Buyers and Sellers

>Homogenous Products

>Free Entry and Exit

>Perfect Information

>No Barriers to Entry or Exit

What does the Web3 market look like?

We compete in a market of open-source, forkable code, of extremely similar, abundant products, with information sharing, auditability/transparency, service aggregators (makes price-shopping and access easier) etc.

It's as close to as perfectly fulfilling these properties of any market as you can imagine.

@basememesdude

Yeah, that'd be a great rebuttal to someone who said otherwise, not a genius.

Banks issuing their own stablecoins isn't being disputed by anyone, not a genius.

What's being disputed is their need to buy ETH in order to do so.

18.9.2023

“Every bank will have its own chain, every bank will have its own stablecoin.” -Sergey Nazarov at #SIBOS

@TheBonerChampp @malucopapi

They don't *need* to, but they'll want to eventually (if they're capital allocators). See attached tweet.

6.7. klo 06.13

The "token not needed" meme is an entirely obsolete way to think about Chainlink. Why?

Because they built a payment abstraction layer (PAL) to convert any form of value into LINK tokens.

So, the token isn't needed *by design* to make it as *easy* as possible for end users, applications, TradFi institutions, to pay in all sorts of different ways:

Bank accounts, stablecoins, other gas tokens, credit cards, whatever. Any of it can become LINK.

That is simply about removing payment friction.

The easier it is to pay for something, the easier it is to get people to actually pay for it.

Therefore, the goal of the token isn't to make it *needed* in the context of how the protocol functions by shoehorning in extra, clunky steps.

The goal is to make the token *wanted* purely from the perspective of the eventual value distribution it gets from the protocol being widely adopted.

See this post from @ChainLinkGod:

The end-state for crypto tokens is protocol equity.

A digital asset that serves as a claim on the future positive cash flows of a blockchain-based protocol.

That’s it, this is how tokens accrue value, no ponzinomics or mental gymnastics required.

@thk4amos_Jok3r @matthew_sigel

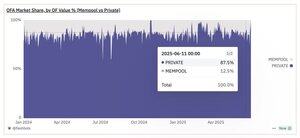

No idea what that means. Nearly 90% of order flow goes to private mempools now.

The real yield of validators is down and will only continue to go down as MEV moves to other parts of the stack and execution is elsewhere.

24.6.2025

PFOF has taken over DeFi.

We are witnessing near-complete orderflow commoditization. Near 90% of orderflow value are being captured by OFA or vertical integrations with builders.

Across all the Ethereum transaction's paid value (gas priority fees + builder tips), only ~12% are left in the public mempool.

@f6zivk >its actually like saying businesses will buy crude to power their factories

Banks don't need to "power" anything on a chain. They create a token contract. The tokens are minted. The users moving tokens around pay the costs.

45,65K

Johtavat

Rankkaus

Suosikit