Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

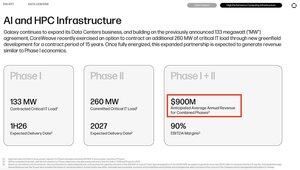

Core Scientific's $CORZ rumored deal with CoreWeave $CRWV should result in a material re-rating of Galaxy Digital's $GLXY shares. $GLXY 's enterprise value ($5.7B) currently represents at a ~20% discount to $CORZ ($7.3B) despite the facts that:

- Galaxy's contracted revenue ($900MM per year) from its CoreWeave lease agreement is larger than Core Scientific's ($850MM)

- The embedded growth in Galaxy's data center business (w/ potential to grow to 2.5GW) is significantly larger than Core Scientific's

- Galaxy owns the only full-stack digital-asset focused financial services platform.

Not only does $GLXY's current valuation imply its data center business is severely undervalued, it also implies you are getting its financial services business for free.

At $17.50 per share for $CORZ (the current price in pre-market trading; note the acquisition price will likely be significantly higher), $CORZ trades at a $7.3B enterprise value. Meanwhile, $GLXY currently trades at a $5.7B enterprise value.

Galaxy's lease agreement with CoreWeave provides for $900MM of avg. annual rent to $GLXY, vs. $850MM for Core Scientific's. CoreWeave would actually save more in annual rent expense by acquiring $GLXY as opposed to $CORZ, which obviously implies that $GLXY is worth more to $CRWV than $CORZ!

Furthermore, Galaxy's lease agreement (393MW critical IT load, 600MW gross) represents under 25% of their total expected power capacity (2.5GW) at their Helios data center campus. Meanwhile, Core Scientific's lease agreement with CoreWeave (590MW critical IT load, 800MW gross) represents the majority of Core Scientific's total expected power capacity. As such, Galaxy's ability to grow its data center capacity well beyond its existing deal with CoreWeave suggests it should trade at a premium to Core Scientific on a per MW of approved power basis, yet it trades at a discount!

Finally, Galaxy possesses a "one-of-one" asset in its digital-asset focused financial services platform. This business, which includes OTC trading and market making for spot and derivatives, investment banking, asset mgmt., and staking, has been consistently profitable since inception, generating over a billion dollars of profits for shareholders! To highlight the historical profitability, consider that $GLXY 's book value per share has compounded from ~$1 in 2018 to $6+ today.

At the current $GLXY valuation, not only are you getting Galaxy's data center business at a fraction of its intrinsic value, you are getting its digital assets business for free.

72,33K

Johtavat

Rankkaus

Suosikit