Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Hello @CryptoHayes I enjoyed this read much and curious to hear your thoughts on the following:

Think we are both in agreement that RRP depletion = QT so net-net there isn't a ton of excess liquidity that gets created. If anything BTFP is being repaid in Q1'25 and that was $50M that was returned in December

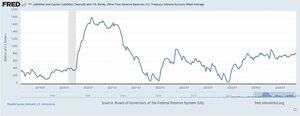

The crux of the conversation seems to be around the use of TGA (as seen below) that could possibly occur starting this week per timeline (Jan 21st)

However your post seems to ignore the "extraordinary measures" that Yellen discussed as confirmed being implemented in her farewell letter re: not paying into accounts (CSRDF and Postal Service Fund) to make up for the shortfall of money relating to an expected ~$2T deficit this year. Believe this alone is expected to produce ~$300B in capacity to spend which could keep the Treasury afloat for ~1.5-2 months

That should be sufficient to get the gov't to tax season which has been ~$4T+ in the last few years. Of course not all of that comes in Mar/Apr but this should provide a relevant buffer b4 the gov't actually taps TGA - and if they do tap - it certainty doesn't seem to the effect of the $600B available but piece meal maybe in $20-25B chunks

So perhaps at some point TGA gets tapped in latter'25 if no productive conversations are to be had around the debt ceiling? However I am not sure how that ties w/ your notion that this would be Q1 bullish alluding to the excess liquidity that would be injected; seems the Fed is largely fine

7.1.2025

“Sasa” is an essay where I explain y I think #crypto tops out in mid-Mar and then severely corrects. Until then is time to dance.

I also think @CryptoHayes has not taken into account the diminishing returns $1 of TGA liquidity has when we observe precedent

2021 is obviously an aberrant example b/c there were many more facilities than just TGA becoming online

When you observe depletion in H1 across 2017/19/23 the total quantum of available dollars from this pool has roughly remained in the same range (~$400-600B)

However, total size of digital assets has vastly outpaced that. You can see this in the below. I don't think expecting a lift is as reasonable as in the past

@plur_daddy

29,79K

Johtavat

Rankkaus

Suosikit