Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

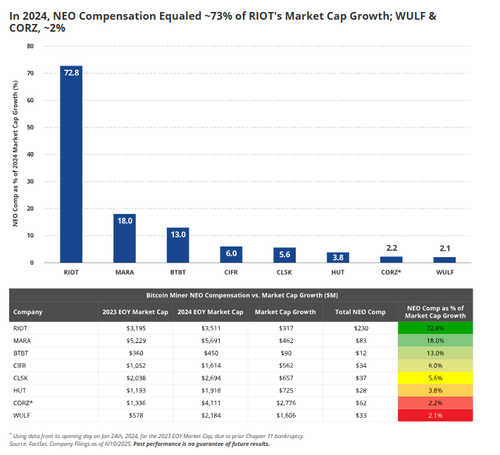

Fast-vesting equity. Uncapped bonuses. 9-figure payouts.

Bitcoin miners are partying like it’s 2021, and shareholders aren’t amused.

We revisit our 2022 analysis and urge boards to tie pay more closely to long-term performance.

🧵

Most miner comp plans still rely on rapid-vesting equity and uncapped bonuses, resulting in exec awards far above energy and IT industry peers.

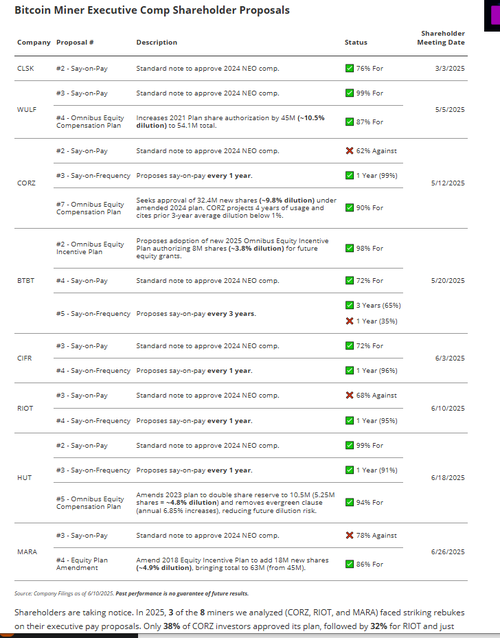

Say-on-pay votes may be advisory, but they matter. Several miners got <70% support this year, vs. ~90% in broader markets.

That’s a governance red flag.

Boards often argue equity aligns incentives.

But alignment requires conditions: performance metrics, clawbacks, long vesting.

Too many plans skip those.

We’re long Bitcoin infrastructure.

But boards must evolve if this sector wants to earn institutional trust.

Boards that get comp right will earn more investor trust and capital.

Full piece is here -->

h/t @n_frankovitz

25,13K

Johtavat

Rankkaus

Suosikit