Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

From the perspective of fiscal expansion 2.0, let's review the market trends of the past few months and what to expect in the future. Last Friday, during a discussion about the recent market trends, we released the audio from that time. 1. Overall, since mid-April, the market has experienced two waves of movement:

The first wave was from mid-April to early June, where there was an increase followed by a slight adjustment, primarily driven by Trump's shift.

The second wave started from the U.S. bombing of Iran's nuclear facilities and the cessation of the Iran conflict until now (implying that the U.S. has not given up on global leadership).

The deadline for tariffs on July 9 was postponed (at that time, we discussed that the market would buy in again).

Last week, inflation met expectations, and the earnings season kicked off positively.

Of course, there are special factors for the cryptocurrency market, such as the passage of the stablecoin bill and the advancement of the digital asset market structure bill.

Characteristics of these two phases: in mid-April, Bitcoin reacted before the U.S. stock market, while by the end of June, the U.S. stock market was stronger.

2. What to expect in the future?

1) Previously, we discussed that the passage of the Great American Plan signifies a transition from tight monetary policy to expansionary policy during Trump's second term, moving from initially pursuing cost reduction and efficiency to focusing on economic growth. We have talked about the significance of the Great American Plan before.

2) Many people overlook that in 2023-2024, the Federal Reserve will be in a phase of monetary policy contraction (raising interest rates, reducing the balance sheet). The Biden administration's "Infrastructure Bill" and "Science and Chips Bill" represent "Bidenomics," which is the underlying support logic for market trends. At the end of 2023, we discussed this point in two tweets about fiscal policy and liquidity. Therefore, it is referred to as fiscal expansion 1.0, and now Trump represents fiscal expansion 2.0.

In the medium to long term, this will form new support for the market. Fiscal expansion 2.0 will likely be accompanied by a continued decline in interest rates (one to two rate cuts within this year, continuing next year, maintaining last year's third-quarter judgment of limited easing within the next two years).

3) The biggest driving force for the cryptocurrency market lies in the stablecoin bill and the digital asset market structure bill, which will bring about a wave of stablecoins, the trend of merging cryptocurrencies and stocks, and the real implementation of RWA, leading to greater mass adoption.

Fiscal expansion 2.0 is the fundamental support logic for the entire macro market, while the stablecoin bill and the digital asset market structure bill provide the support logic for crypto assets, forming a solid foundation for the medium to long-term market.

3. What are the possible risks in the future?

1) However, we have previously discussed that the biggest policy constraint of fiscal expansion 2.0 is the increasing scale of U.S. debt. Although there is no crisis of U.S. debt default, there is a risk that long-term bond yields will rise, suppressing market risk appetite and impacting risk assets.

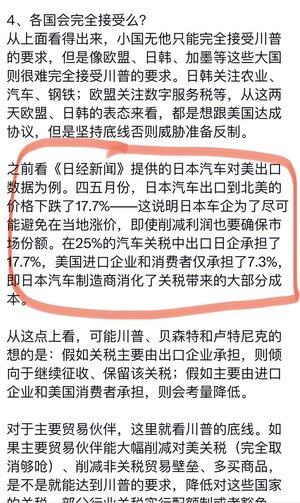

2) In the short term, the tariff deadline on August 1 is approaching. Previously, in the tweet about what Trump wants regarding tariffs,

The risk lies in Trump's unwillingness to compromise, and it is difficult for the EU, Japan, and South Korea to reach an agreement (it seems they do not expect much concession from Trump). If the new tariffs are implemented on August 1, it will have a certain impact on the market. Especially since Trump is starting to get annoyed by being told that he always backs down at critical moments. Last week, the Wall Street Journal reported that Trump only abandoned the hasty dismissal of Powell under the advice of Bessent. Today, Trump stated, "I don't need anyone to explain the stakes to me; I only explain to others," showing visible anger. We cannot expect Trump to always compromise.

Of course, if an agreement is not reached and the tariffs are announced directly, I believe the impact will be much smaller than the level seen in early April. The U.S. stock market will likely only see a minor adjustment, and the cryptocurrency market will naturally be affected. Then, if Bessent intervenes, it is also possible to reduce the newly added tariffs, which could present another opportunity to enter the market.

In the short term, we also need to pay attention to inflation trends. My personal view has always been that the product inflation caused by tariffs will be offset by the weakening energy inflation and service industry inflation.

Overall, the medium to long-term logic is solid, and there will be several minor risk shocks that will lead to market adjustments, but I personally see a low probability of a super large-scale risk shock similar to that of March and April.

16.7. klo 20.53

The recently released U.S. June PPI data all fell short of expectations and were lower than previous values, especially with the PPI and core PPI month-on-month rates both at 0%, significantly below expectations. As the price index at the wholesale level, PPI serves as an upstream indicator for inflation data like CPI and PCE, suggesting that the June PCE data should be quite good, and it even provides a leading indication for July's inflation data. This is positive data for the market. The day before yesterday, I mentioned that "greed is harder to reverse than fear," which undoubtedly boosts market sentiment and future interest rate cut expectations.

The PPI (Producer Price Index) has significantly decreased across the board from producers to wholesalers, showing no reflection of tariff impacts. I believe there are two reasons for this:

1. Today’s tweet on "What does Trump really want regarding tariffs?"

2. The weakness in the service sector; the June PPI data falling short of expectations is largely due to the decline in service sector prices. Yesterday's CPI data also showed that the core CPI month-on-month was below expectations.

69,34K

Johtavat

Rankkaus

Suosikit