Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

【ENA is up ≈ 47 % this week😳】 @ethena_labs

WHY?

👉 On expectations that Fee Switch—which redirects protocol fees to sENA holders—could go live soon.

Why it matters?

👉 0.10 % mint fee on every USDe (plus other revenue streams) will flow to stakers once the switch flips🔥

Turning ENA into a yield-bearing asset typically fuels buy-side pressure.

Checklist to trigger Fee Switch (and where we stand)

1) USDe in circulation > $6 B ✅ (≈ $6.8 B)

2) Cumulative protocol revenue > $250 M ✅ (≈ $431 M)

3) Reserve fund ≥ 1 % of supply ✅

4) Listed on 4 of top-5 derivatives CEXs ⏳ (now 3)☑️

5) sUSDe APY spread 5–7.5 % ⏳ (currently ~3 %)☑️

✅Only 2 boxes left to tick—another major CEX listing or a wider yield spread could flip the switch any day.

You can trade ENA on @Backpack Exchange🎒

21.7. klo 03.14

Ethena's $ENA is up 47% over the last 7 days, but what is driving the rally?

Aside from positive market tailwinds with crypto asset prices rising across the board, ENA's rally stands out for one key reason: Speculation on Fee-Switch Activation

ENA is unique, where the fee switch parameters have already been established, but require certain thresholds to be met or exceeded for It to be formally activated, in which case sENA holders would be the fee recipients.

These fees are primarily generated via 10 bip mint fees on USDe, but other protocol revenue streams exist as well.

The parameters are:

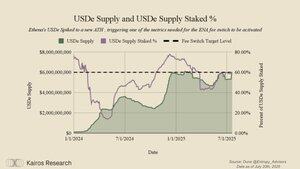

✅ USDe circulating supply: $6.08bn (threshold: >$6bn)

✅ Cumulative protocol revenue: $431.31m (threshold: >$250m)

❌ CEX adoption: USDe CEX adoption: 3 (threshold: 4 of the top 5 CEX by derivatives volume)

✅ Reserve Fund ≥ 1% of USDe supply

❌ sUSDe APY spread vs benchmark: (threshold: 5.0-7.5%)

While the last parameter is not yet within range, the current spreads for sUSDe vs other benchmarks are as follow:

Spread vs AAVE USDC: 3.03%

Spread vs T-Bill: 2.48%

Spread vs sUSDS: 2.05%

The avg 30d apy for sUSDe is 5.59% and the current apy is 9.74% at the time of writing.

Additionally, the influx of staked sUSDe vs other key benchmarks like Maker/Sky's sUSDS signal that capital allocators expect the spread to widen in Ethena's favor, as seen in the chart below

36,64K

Johtavat

Rankkaus

Suosikit