Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

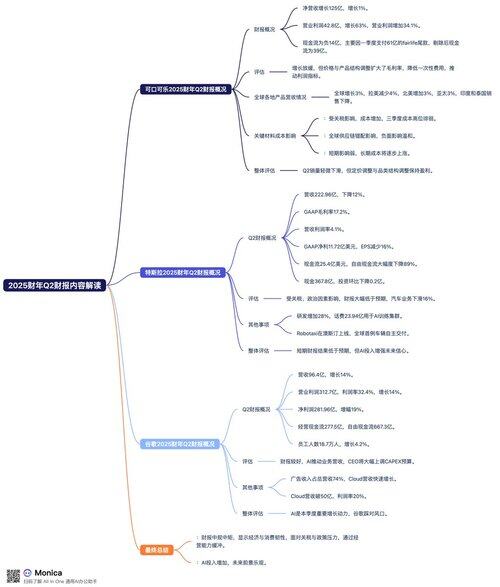

Supplementary update: Coca-Cola, Tesla, Google Q2 2025 financial report analysis:

Coca-Cola, as the world's largest fast-moving consumer goods company, has a relatively standard financial report, showcasing the current resilience of the economy and consumer spending.

From its financial report, it can be seen that in the face of tariffs and policy pressures, Coca-Cola is making relative adjustments through its operational capabilities.

If tariff policies continue to worsen, it will pose significant challenges for the company.

As for Tesla and Google's financial reports, they seem to present one good and one bad outcome, but we can see that both have increased their investments in AI and artificial intelligence for the future, indicating that AI remains a key focus moving forward.

Jul 20, 22:02

July 21 - July 25 Macroeconomic Major Events Summary: (Time calculated according to UTC+8)

This week is temporarily in a macro "vacuum period," with no significant news in macro data. However, the Q2 earnings season for U.S. stocks is approaching, and the U.S. stock market is entering a pressure testing phase.

Additionally, the U.S. tariff negotiations with the world will become normalized before August 1.

Monday, July 21

20:30: U.S. telecom giant Verizon will release its Q2 earnings report.

Tuesday, July 22

20:30: Federal Reserve Chairman Powell will deliver the opening remarks at the "Comprehensive Assessment of Large Bank Capital Framework" meeting in Washington, with Bowman and Waller also speaking afterward.

20:30: Coca-Cola Company Q2 earnings report for fiscal year 2025.

Thursday, July 24

01:00: U.S. 20-year Treasury bond auction.

04:00: Tesla and Google Q2 earnings report for fiscal year 2025.

Friday, July 5

7:30: Japan's CPI data.

Assessment:

This week, there are not many macro focal points, mainly paying attention to Powell's speech and Japan's CPI.

1. It is unknown whether Powell will accept interviews during the meeting. If he does, the most likely questions will be regarding Trump's "attack" comments on Powell, focusing on how confident Powell is.

2. The other two participants, Bowman and Waller, are particularly "dovish" Federal Reserve governors recently, showing obvious "political correctness." It will be interesting to see what different "sparks" they create with Powell during the meeting.

3. Japan's CPI is not the main focus, but given the recent rebound in Japanese inflation causing public dissatisfaction, Shigeru Ishiba's approval rating has reached a level where he could step down. If inflation rebounds again, can Ishiba remain in office?

Another key point is the U.S. stock earnings, especially since Google and Tesla are releasing their earnings reports on the same day. If there are "issues" in the reports, will it trigger significant fluctuations in the U.S. stock market and reveal market carelessness?

On the other hand, regarding the 20-year U.S. Treasury bonds, I personally believe there won't be too many issues, as the current yield is evident. Even if pursuing high yields, there will still be funds buying in.

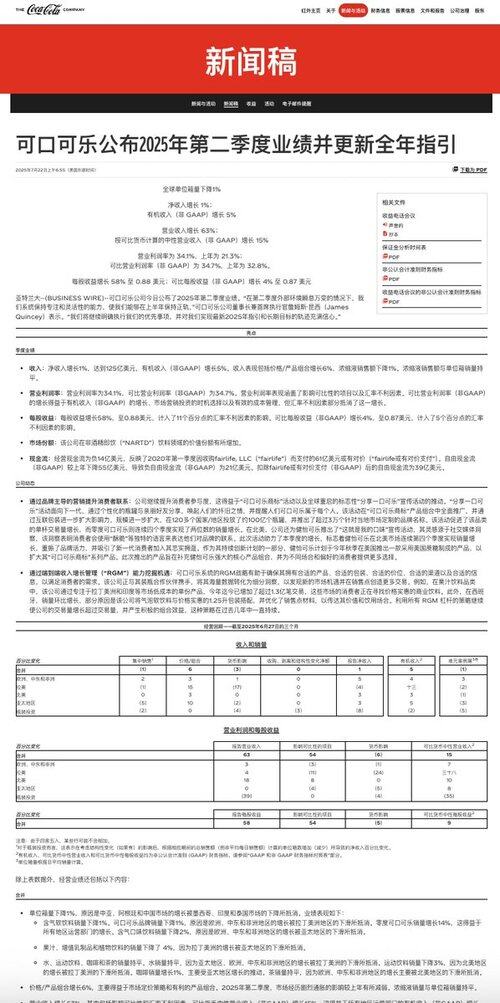

Coca-Cola Q2 Financial Report Overview for Fiscal Year 2025:

Financial Report Overview:

1. Net revenue increased by 12.5 billion, up 1%,

2. Operating profit of 4.28 billion, up 63%, with operating profit increasing by 34.1%

3. Cash flow was negative 1.4 billion, mainly due to the payment of 6.1 billion for fairlife in the first quarter. Excluding this expense, cash flow for this quarter would be 3.9 billion.

Assessment:

Growth has slowed, but price adjustments and changes in product structure have expanded the gross margin, while one-time expenses have significantly decreased, indicating a phase of cost reduction and efficiency improvement, ultimately driving profit metrics closer to revenue.

Global Product Revenue Situation:

Global growth of 3%, with Latin America down 4% due to inflationary pressures, North America up 3%, and Asia-Pacific up 3%, although sales in India and Thailand have declined.

Key Materials: Impact of Aluminum Cans, PET Resin, and Caramel Color Costs:

Aluminum cans have seen increased costs due to tariffs, which are a major inflation factor in Coca-Cola's packaging. If tariffs continue, costs are expected to remain high in the third quarter.

PET resin, on the other hand, has been relatively less affected by tariffs compared to the negative impacts of global supply chain mismatches.

3. Caramel color has a weak short-term impact, but in the long term, costs are expected to gradually rise due to regulations and concentrated production capacity.

Overall Assessment:

Coca-Cola's Q2 sales have slightly declined, but the company has managed to maintain good profitability through pricing adjustments and changes in product categories.

To put it more plainly, the Q2 financial report is decent, mainly due to the company's operational capabilities being assured. However, facing tariff issues and global economic challenges, the financial report still presents certain tests.

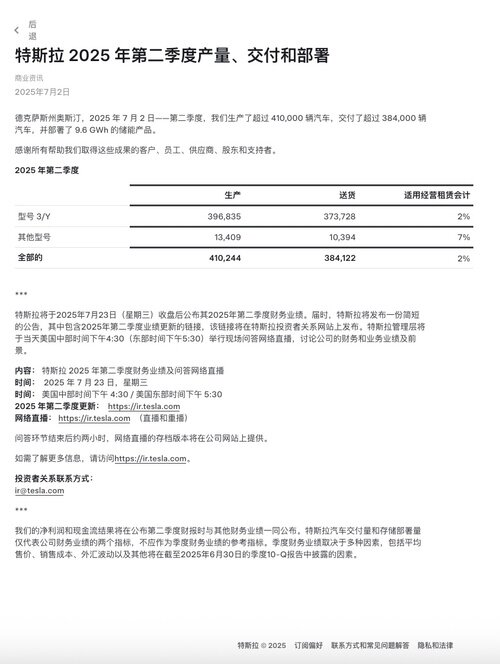

Tesla Q2 Financial Report Overview for FY 2025:

Q2 Financial Report Overview:

1. Revenue of $22.296 billion, down 12%

2. GAAP gross margin of 17.2%

3. Revenue profit margin of 4.1%

4. GAAP net profit of $1.172 billion, EPS down 16%

5. Cash flow of $2.54 billion, free cash flow at 1.46%, a significant decrease of 89%

6. Cash of $36.78 billion, investment down by $20 million quarter-over-quarter,

Assessment:

Due to tariffs and political factors, Tesla's Q2 financial report was significantly below expectations, with automotive business down 16%, energy storage down 7%, and services and other businesses up 17%.

Increased regulation and a decline in delivery volume, along with increased investment in AI, have led this period's financial report to be in a "overdraft" phase.

Other Matters:

1. R&D increased significantly by 28%, with $2.394 billion spent on AI training clusters, highlighting Tesla's stronger commitment to the future of AI. Of course, free cash flow remains ample.

2. Technically, Robotaxi launched its first safety attendant in Austin in June, achieving the world's first autonomous vehicle delivery, while also increasing the procurement of 16,000 H200 GPUs.

Overall Assessment:

Although Tesla's short-term financial results were significantly below expectations, raising market concerns, Musk, or rather Tesla's pursuit of technology and AI, has paradoxically strengthened confidence in Tesla's future through increased R&D investment.

Despite the adverse effects of tariffs and political factors leading to poor overall revenue in Q2, with excellent cash flow and greater, faster technological investments, Tesla will continue to maintain a top-tier position in the technology field, which will also bring more possibilities for Tesla's future corporate prospects and stock prices.

Overall, while the short-term outlook is unfavorable, the long-term perspective remains relatively optimistic.

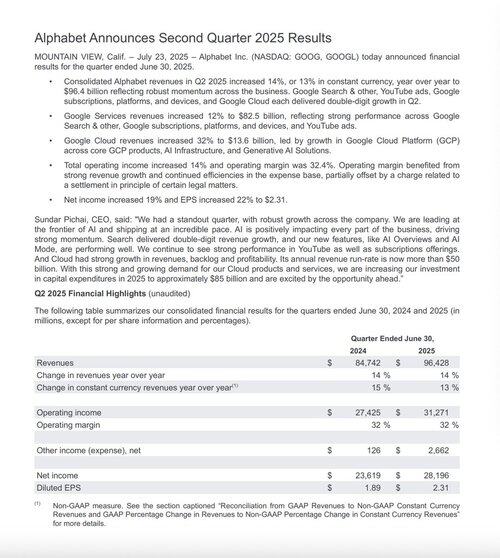

Overview of Google's Q2 2025 Financial Report:

Q2 Financial Overview:

1. Revenue: $9.64 billion, up 14%

2. Operating profit: $31.27 billion, profit margin 32.4%, up 14%

3. Net profit: $28.196 billion, growth of 19%

4. Operating cash flow: $27.75 billion,

5. Free cash flow: $66.73 billion,

6. Number of employees: 187,000, up 4.2%

Assessment:

A solid financial report, primarily driven by artificial intelligence, which has brought better business revenue to Google. Additionally, the CEO stated that there will be a significant increase in the CAPEX budget, reflecting greater investment in technology and artificial intelligence.

Other Matters:

1. Advertising revenue accounts for 74% of total revenue, but Cloud revenue is rapidly catching up.

2. Cloud revenue exceeded $5 billion, with a profit margin of 20%, becoming a major driver of marginal profit.

3. TAC receivables at 15.2%, up 20 basis points, with traffic acquisition costs increasing in line with advertising growth.

Overall Assessment:

Google's financial report indicates that betting on AI and artificial intelligence is the most important growth driver this quarter. Furthermore, AI and artificial intelligence are also key initiatives currently promoted by the Trump administration in the U.S. Google's report highlights one thing: being on the right trend is more important than anything else.

However, it is important to note that as Google's advertising grows, costs are also increasing, so in the future, Cloud may gradually take over as the main source of Google's revenue.

5.14K

Top

Ranking

Favorites