Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

July 21 - July 25 Macroeconomic Major Events Summary: (Time calculated according to UTC+8)

This week is temporarily in a macro "vacuum period," with no significant news in macro data. However, the Q2 earnings season for U.S. stocks is approaching, and the U.S. stock market is entering a pressure testing phase.

Additionally, the U.S. tariff negotiations with the world will become normalized before August 1.

Monday, July 21

20:30: U.S. telecom giant Verizon will release its Q2 earnings report.

Tuesday, July 22

20:30: Federal Reserve Chairman Powell will deliver the opening remarks at the "Comprehensive Assessment of Large Bank Capital Framework" meeting in Washington, with Bowman and Waller also speaking afterward.

20:30: Coca-Cola Company Q2 earnings report for fiscal year 2025.

Thursday, July 24

01:00: U.S. 20-year Treasury bond auction.

04:00: Tesla and Google Q2 earnings report for fiscal year 2025.

Friday, July 5

7:30: Japan's CPI data.

Assessment:

This week, there are not many macro focal points, mainly paying attention to Powell's speech and Japan's CPI.

1. It is unknown whether Powell will accept interviews during the meeting. If he does, the most likely questions will be regarding Trump's "attack" comments on Powell, focusing on how confident Powell is.

2. The other two participants, Bowman and Waller, are particularly "dovish" Federal Reserve governors recently, showing obvious "political correctness." It will be interesting to see what different "sparks" they create with Powell during the meeting.

3. Japan's CPI is not the main focus, but given the recent rebound in Japanese inflation causing public dissatisfaction, Shigeru Ishiba's approval rating has reached a level where he could step down. If inflation rebounds again, can Ishiba remain in office?

Another key point is the U.S. stock earnings, especially since Google and Tesla are releasing their earnings reports on the same day. If there are "issues" in the reports, will it trigger significant fluctuations in the U.S. stock market and reveal market carelessness?

On the other hand, regarding the 20-year U.S. Treasury bonds, I personally believe there won't be too many issues, as the current yield is evident. Even if pursuing high yields, there will still be funds buying in.

15.7. klo 03.50

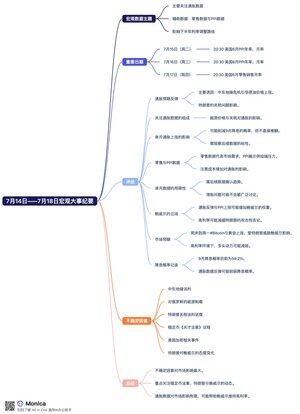

July 14 - July 18 Macroeconomic Event Summary: (Time calculated according to UTC+8)

This week's macro data focuses on inflation data, with supporting data being retail data and PPI data, reflecting the inflation situation in the U.S. for June,

as well as the stimulative effects of global geopolitical and tariff issues on inflation, thereby affecting the interest rate adjustment path for the second half of the year.

On Tuesday, July 15,

20:30 U.S. June PPI year-on-year and month-on-month,

On Wednesday, July 16,

20:30 U.S. June PPI year-on-year and month-on-month

On Thursday, July 17

20:30 U.S. June retail sales month-on-month

Assessment:

1. Inflation expectations have rebounded, and I personally judge that the actual situation is indeed the same, even stronger than expected. The main drivers leading to the rise in inflation are twofold: one is the Middle East geopolitical crisis in June leading to a rise in oil prices, with price fluctuations directly impacting both supply and demand, causing inflation to rebound.

2. The second is Trump's tariff issues; this is the third month of data since the tariffs were proposed on April 2. According to the logic that tariffs lead to inflation with a slower transmission, the June and July data will more intuitively show the impact of tariffs on inflation.

Therefore, it is crucial to pay attention to how much of the inflation data is stimulated by energy prices and how much is driven by tariff issues.

3. Please note that a single month's inflation increase will reduce the probability of a rate cut in September, but it will not directly overturn it. The key is to see whether the inflation rebound in June leads to sticky inflation data in July and August.

4. Retail data represents market demand, while PPI data shows the pressure that tariffs and energy prices exert on the supply side. It is also important to note the inflation caused by rising costs and whether the supply side is experiencing a one-time increase in costs affecting the demand side.

Expectations are that PPI data may rise, which will lead to a weakening of retail data, thereby raising expectations of economic stagflation risks.

5. Of course, single-month data does not have sufficient explanatory power and cannot directly lead to a sense of crisis regarding the economy; subsequent data needs to continue to decline. Therefore, if the data meets my expectations, the stagflation issue will not be discussed for the time being, or will be discussed on a small scale.

6. If inflation rebounds, PPI data rises, and retail declines, once this logic is met, it may increase Powell's weight. Powell will have more reasons to maintain high interest rates, effectively mitigating Trump's aggressive rhetoric against him.

7. My personal expectation is that the rise of #Bitcoin and gold from the weekend to Monday is still due to Trump's threats to Powell. If the data shows that maintaining high interest rates is more favorable, the probability of Powell being threatened will decrease, which will weaken the bullish momentum.

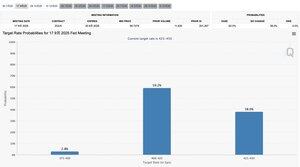

8. For the record, the probability of a rate cut in September is currently 59.2%. I remind you again that a single month's inflation data rebound may weaken the rate cut probability, but it will not directly overturn it; we still need to see how sticky the inflation is in the later period.

Uncertain factors:

1. Middle East geopolitical negotiations, whether the U.S. and Iran can successfully negotiate to ease energy prices

2. Energy sanctions against Russia

3. Progress of Trump's tariff negotiations

4. The agenda of the stablecoin "Genius Act"

5. U.S. cryptocurrency-related events, this week is regarded as crypto week

6. Whether Trump's aggression towards Powell is increasing or decreasing

7. This week, there are 12 speeches from Federal Reserve governors, which may continue to showcase a "political show"

Summary:

The above is the summary of this week's major macro events. Personally, I feel that the uncertain factors have the greatest impact on the market. This week's focus is on the stablecoin bill, Trump and Powell, followed by tariff negotiations.

As for the inflation data, I personally feel that its impact on the market will not be too significant; it will weaken the probability of a rate cut in September, but it does not directly negate the rate cut in September. At the same time, this data may help Powell maintain the current high interest rates.

15,36K

Johtavat

Rankkaus

Suosikit