Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

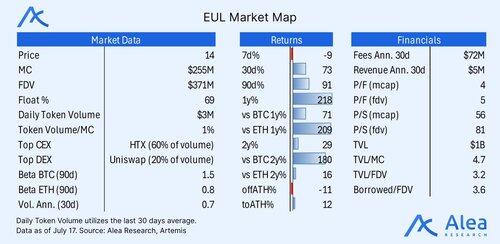

Euler is not just a money market - DEX hybrid; it's a budding DeFi operating system.

Euler's modular design combines trading, lending & leverage, resulting in sticky infrastructure for token issuers and asset managers.

Today we've released a Thesis report on $EUL 👇

19.7. klo 17.17

1/ Euler is a misunderstood protocol, but is $EUL mispriced?

Flexibility and customization is everything for asset managers, asset issuers, and protocols building on top

Optionality is the name of the meta-protocol game

🧵👇

With >$1.3B borrowed & a FDV shy of $400 million, $EUL has a Borrowed/FDV ratio of >3x (114% greater than Maple’s $SYRUP and 150% greater than $MORPHO).

Euler is the credit market with the highest utilization rate globally and the highest number of vault combinations.

Key Takeaways:

- $EUL ownership is shifting from VC to liquid fund dominance as fundamentals improve.

- P/F (FDV and MC) valuation multiples have compressed by ~80% YTD, now trading significantly below their historical averages.

- Divergences in price/TVL/fee correlations help distinguish between moves driven by fundamentals versus narrative.

- $EUL trades at a marketcap of just $270M despite being the lending market with the greatest diversity and options for yield strategies.

$EUL currently stands out with a P/F (fully-diluted) multiple of ~5.2x. This is relatively low compared to peer protocols like:

- $AAVE (8.2x)

- $MORPHO (18x)

- $SYRUP (40x)

EulerSwap:

EulerSwap redefines the asset issuance playbook, building on top of Euler’s existing primitives.

This comes at a time when stablecoins are top-of-mind, along with other targeted efforts involving LSTs, LRTs, PTs, or RWAs.

Frontier:

Conceived by @objectivedefi, Frontier packages Euler’s lending vaults, swap routing, and cross‑vault netting into an off‑the‑shelf “correlated market” template.

In its first month, Frontier crossed $150 M in deposits across 10 markets.

Compared with competitors, $EUL remains the cheapest on cash flow multiples, highlighting a valuation that still implies the heaviest discount to run-rate revenue.

Our $EUL thesis is based on Euler being both misunderstood & mispriced as most ignore the optionality premium that comes with being a meta-protocol with an active buyback program as fundamentals improve.

Our full length $EUL Thesis report is exclusive for our premium members.

Join our ranks today or browse our selection of free content, link in bio.

11,03K

Johtavat

Rankkaus

Suosikit