Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Let's digresse with Jason's post.

How is the Entry/Exit Queue Time Calculated for Ethereum Staking?

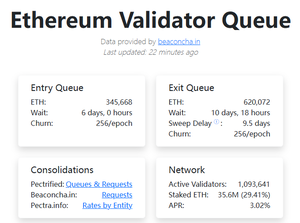

In the past, Ethereum set this [Churn] metric to prevent the number of nodes participating in the consensus from changing too quickly, leading to unnecessary fluctuations (everything is mainly 😂 stable).

This churn rate slowly increases with the increase in the overall staking scale, for example, the current maximum is 8 nodes per epoch, which is 256/epoch in the chart if calculated based on 32 $ETH per node.

An epoch on Ethereum consists of 32 blocks, or 6.4 minutes, with a maximum of 8 nodes entering/exiting every 6.4 minutes. This is the technical reason for limiting the queue for Ethereum Staking in and out.

What about the follow-up? So Ethereum pushed the Prague upgrade, allowing a single node to deposit ETH from 32 to 2048 $ETH →.

It is to deal with this kind of "big hit" mortgage or unpledge.

Imagine if we assume that 600,000 Ethereum belongs to several large users and each person is full from 32 to 2,048 nodes, then their withdrawal will be shortened from 9 days of queuing to about 3 hours.

In other words, before the information ferments, the tokens have already been recharged to Binance OKX 😂

Of course, after the Prague upgrade, the adoption of large nodes is currently slowly increasing, and after looking at beaconcha, roughly speaking, about four or five hundred people have upgraded to large node mode.

There will definitely be more and more large nodes on Ethereum in the future, and we will also see less and less queue time.

23.7. klo 09.37

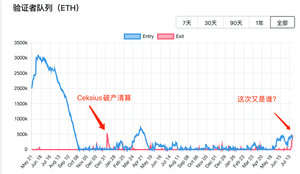

Recently, there has been a lot of discussion about the sudden appearance of over 500,000 ETH queued for unstaking. Many people are worried about the risk of a market crash. Currently, it is still unknown who is unstaking on such a large scale. Let me share my thoughts. To start with the conclusion, this level of collective unstaking must be the action of a single institution, which I will elaborate on below.

In the history of Ethereum's transition to POS, as shown in Figure 2, if we extend the timeline, the last time such a large-scale unstaking occurred was in January of last year when Celsius went bankrupt and urgently needed cash, instantly unstaking over 500,000 ETH, which caused the entire network's validator queue to be blocked for 7 days. This time, we are seeing a similar scale of unstaking, and the entire network has been blocked for 8 days. So, who is about to go bankrupt again? Or is someone looking to profit and escape? (Sun Ge, if it's you, blink 👀)

However, if we only look at the situation of entering and exiting the staking queue, this time there is no need to panic like last time. Last time, compared to the amount of unstaked ETH, the amount entering staking was almost negligible. This time, as shown in the figure above, there have been several days where the number of entries into staking has been roughly equal to the number exiting, so it can almost offset each other, and there is no need to be overly anxious.

12,75K

Johtavat

Rankkaus

Suosikit