Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

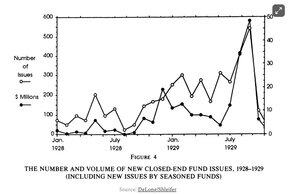

insane similarities. operating companies reliant on mnav prem and long term debt issuance to fuel asset purchases in a reflexive cycle, sought to buy scarce assets, pundits (fisher) defending trusts as support for asset valuations because they made access easier and broadened TAM, insistence on ability to buy back shares at discount if situation arises (*ineffective when liquidity across the ecosystem vanishes and selling pressure dominates*) - didn't collapse because of fraud or lack of oversight, collapsed because of their own success in creating systemic reliance (>500 vehicles at peak) on long term leverage & nav premiums, amplifying the market downturn & in many cases wiping out common equity holdings.

27.7. klo 21.37

excellent post from @bewaterltd. compares the DATs (bitcoin access vehicles I call them) with the investment trust (closed end mutual fund) mania of the 1920s. many, many similarities.

30,14K

Johtavat

Rankkaus

Suosikit