Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Leo the Horseman (wartime arc)

I trade GPUs, eggs, and all other human delusions. | Chief Janitor@ ████████

If you can understand Robinhood's business model, you can understand aPriori.

Few.

aPriori ⌘26.7. klo 22.00

1/ Today, we’re announcing Swapr: the AI-powered DEX aggregator that works for you.

In TradFi, order flow segmentation enables PFOF where value accrues to brokers & MMs.

Swapr flips that: instead of selling user flow, it identifies high-value users and improves their execution.

5,47K

This afternoon, I read an article called <Market Prices Are Not Probabilities> in the car, which was quite enlightening. It refuted the mainstream conclusions regarding prediction markets, so I’ll briefly share my thoughts after reading it.

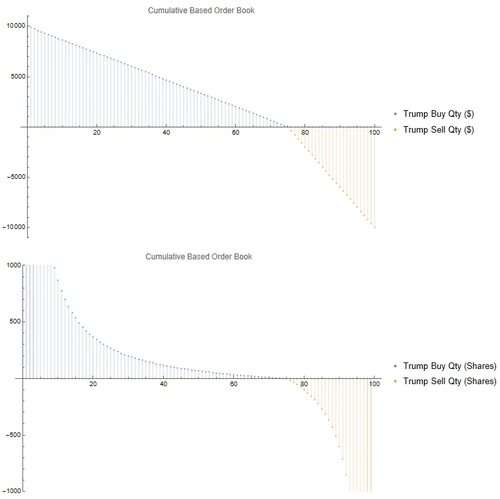

Currently, the core viewpoint of prediction markets and InfoFi is that prices on a sufficiently liquid order book can reflect the strength of the crowd's belief in a certain event better than polls.

This InfoFi thesis is quite beautiful, but there is a fatal flaw:

"The convexity of long-tail bets is much higher than its opposite."

This sentence is a bit convoluted, so I’ll try to translate it: convexity refers to the curvature of the return function concerning the amount wagered. During this period of trading and signal filtering, I found that on Polymarket, apart from professional gamblers and insiders, the participants mainly fall into two categories: "small bets for big wins" and "big bets for small wins."

When the capital size is relatively small, people tend to place bets at higher odds, generally in the range of YES ∈[0.1, 0.5] (the same applies to NO). On the other hand, large funds are accustomed to earning fixed returns of [0.9, 1] before the event settles.

Moreover, due to insufficient liquidity on the order book and its visibility on-chain, large funds placing orders or buying at market price will significantly increase their trading friction, leading them into a classic "Mexican standoff problem," where everyone is incentivized to place their bets at the last moment.

This results in prices not accurately reflecting people's beliefs, creating a significant gap. Therefore, many institutions directly cite the odds data from @Polymarket as another form of polling, which is convenient but has a considerable gap.

So, is the prediction market doomed? If the gap between price and probability is so deep, how has Polymarket managed to grow and achieve considerable success?

One explanation is that this gap is mathematically well-constrained and is a negligible term, which I won’t elaborate on here;

Another explanation is that if people bet according to the Kelly criterion, then market prices equal the probability estimates weighted by traders' wealth. Such rational bettors will become increasingly wealthy, and eventually, their betting proportion will become more significant, causing market prices to closely approach probabilities.

I find both explanations quite absurd and not very convincing. However, there will always be some new solutions; here are a few examples:

1. Design non-uniform continuous prediction markets.

2. The scale of agent participation in betting continues to expand.

3. Large bets use RFQ.

...

The above ramblings do not hinder small gambling for pleasure in the market; they are merely for my weekend mental exercise. Discussion is welcome.

13,79K

Let's briefly talk about the collaboration between @Kalshi and xAI. Many people believe that Elon Musk is once again playing both sides between the two giants of the prediction market. This is generally true, but there are subtle differences.

The entity announcing the collaboration with Kalshi is @xai, which will generate a series of summaries about market conditions, integrated into a webpage. Meanwhile, @Polymarket announced that the collaborating entity is @X.

Although xAI has acquired X through a full stock trading method (this move was mainly due to Musk's financial considerations and compliance issues with Grok's training data), they are still two relatively independent teams.

Aside from calling Grok, a significant point for Polymarket and X is the development of @AskPolymarket, which frequently calls the Twitter API to gather user interests on various topics while providing fact-based judgments with odds based on the existing market.

@AskPolymarket am I right?

1,8K

AdventureX's speed, quality, and breadth of dissemination have already matched @cluely in my heart. I would like to call Ryan Zhu the Roy Lee more suited for Chinese babies' constitution. I have a plan: let ZhenGe immediately invest a few million dollars in Ryan Zhu to start an AI startup. I've even thought of the company slogan, "Shit on everything."

9,02K

Pandemic Labs just released the token $VIRUS for @addicteddotfun on @believeapp, and the opening price of 3M feels a bit high.

What's interesting is that the verified official Twitter on Believe is not the official account of Addicted, but rather the famous empty Twitter account @null, which is quite mysterious.

3,01K

Leo the Horseman (wartime arc) kirjasi uudelleen

All dreams will come true in a bull market.

1. The development of the world is non-linear.

Most of the time is spent accumulating in a mundane way, and when conditions are ripe, everything changes dramatically in a short time. The price of Bitcoin is the best example: three years of silence, one year of wild fluctuations.

2. Seizing opportunities can change your fate.

Learning to speculate is a form of humility, recognizing that personal efforts are limited, and one must seize opportunities when trends change to have a chance at greater achievements.

3. Now or never.

Opportunities have a time limit; if missed, you have to wait another four years, and life doesn't have that many four-year spans.

4. Use less leverage in the market and more leverage outside the market.

A bull market is not just about going all in; it is also a spotlight stage for entrepreneurship, fundraising, and launching new products.

It's not easy for people in the crypto space.

I hope everyone enjoys the bull market, "make a big score and retire," seize every opportunity to elevate yourself, break free from constraints, and do what you truly love.

11,01K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin