Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

This afternoon, I read an article called <Market Prices Are Not Probabilities> in the car, which was quite enlightening. It refuted the mainstream conclusions regarding prediction markets, so I’ll briefly share my thoughts after reading it.

Currently, the core viewpoint of prediction markets and InfoFi is that prices on a sufficiently liquid order book can reflect the strength of the crowd's belief in a certain event better than polls.

This InfoFi thesis is quite beautiful, but there is a fatal flaw:

"The convexity of long-tail bets is much higher than its opposite."

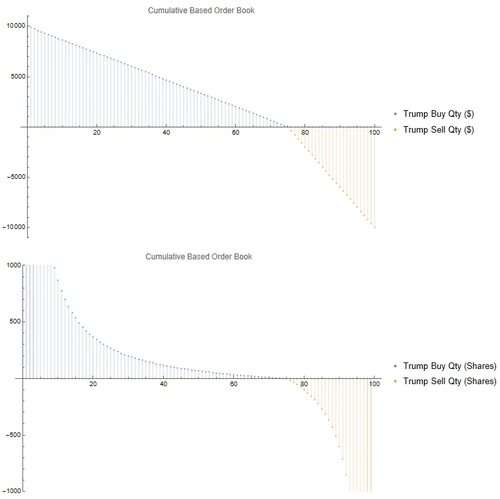

This sentence is a bit convoluted, so I’ll try to translate it: convexity refers to the curvature of the return function concerning the amount wagered. During this period of trading and signal filtering, I found that on Polymarket, apart from professional gamblers and insiders, the participants mainly fall into two categories: "small bets for big wins" and "big bets for small wins."

When the capital size is relatively small, people tend to place bets at higher odds, generally in the range of YES ∈[0.1, 0.5] (the same applies to NO). On the other hand, large funds are accustomed to earning fixed returns of [0.9, 1] before the event settles.

Moreover, due to insufficient liquidity on the order book and its visibility on-chain, large funds placing orders or buying at market price will significantly increase their trading friction, leading them into a classic "Mexican standoff problem," where everyone is incentivized to place their bets at the last moment.

This results in prices not accurately reflecting people's beliefs, creating a significant gap. Therefore, many institutions directly cite the odds data from @Polymarket as another form of polling, which is convenient but has a considerable gap.

So, is the prediction market doomed? If the gap between price and probability is so deep, how has Polymarket managed to grow and achieve considerable success?

One explanation is that this gap is mathematically well-constrained and is a negligible term, which I won’t elaborate on here;

Another explanation is that if people bet according to the Kelly criterion, then market prices equal the probability estimates weighted by traders' wealth. Such rational bettors will become increasingly wealthy, and eventually, their betting proportion will become more significant, causing market prices to closely approach probabilities.

I find both explanations quite absurd and not very convincing. However, there will always be some new solutions; here are a few examples:

1. Design non-uniform continuous prediction markets.

2. The scale of agent participation in betting continues to expand.

3. Large bets use RFQ.

...

The above ramblings do not hinder small gambling for pleasure in the market; they are merely for my weekend mental exercise. Discussion is welcome.

14,68K

Johtavat

Rankkaus

Suosikit