Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

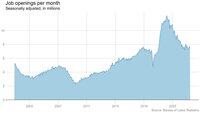

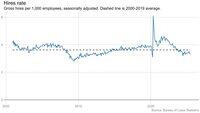

A quick #JOLTS 📈🧵, starting with openings, which seem to have stabilized at more or less their prepandemic rate.

Jul 29, 2025

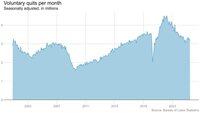

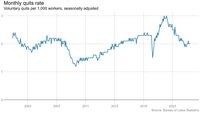

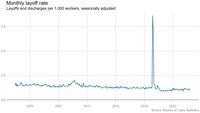

June #JOLTS data shows labor market continuing to cool, but gradually. Openings down (reversing weird May jump), hires down, quits and layoffs basically flat. Consistent with the "no hire, no fire" labor market we've been in for a while now.

Data:

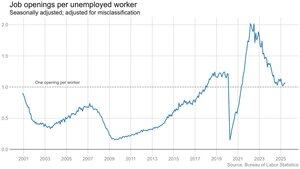

There is roughly one open job for every unemployed worker. Before the pandemic, that ratio stood around 1.25:1, so the labor market is a bit cooler today by that measure (but still quite strong by historical standards). At the hottest point of the postpanedemic reopening boom, the ratio hit 2:1.

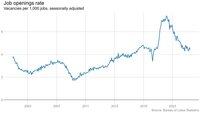

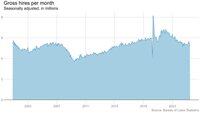

The hiring rate fell in June but seems to have more or less stabilized. The bad news: It has stabilized at roughly its 2013 level, which is not a period anyone would describe as a strong labor market.

The quits rate, on the other hand, has stabilized at more like its 2015/2016 level -- still not what we remember as a hot labor market, necessarily, but definitely a much better one than 2013.

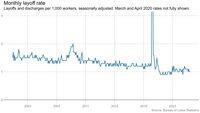

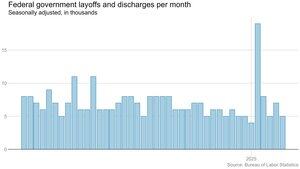

But despite the decline in hires and quits, layoffs remain very low. They've picked up from their record-low levels after the pandemic, but they're still lower than at any time before then.

Note that those layoff totals mostly exclude the big DOGE cuts, because most of those workers are still technically on payroll. We should see those cuts show up in the fall when the paid leave period ends.

13.13K

Top

Ranking

Favorites