Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Is $PUMP set to become the most hated rally?

A valuation analysis of Pump Fun and what to expect from launch.

🧵

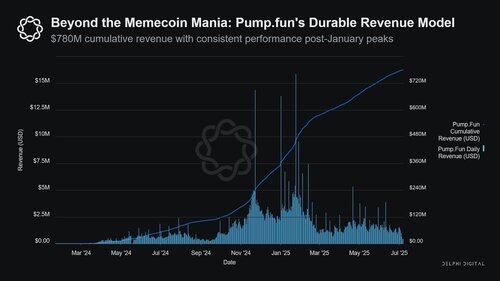

1/ Pump has quietly built one of crypto's most profitable businesses, generating $780M+ in cumulative revenue with no token incentives.

Even once you take out January's memecoin craze, Pump is still generating around $1.3M per day on average.

That's more than what most protocols make in their entire existence.

2/ At $4B FDV, Pump is priced at 20.34x FDV/Earnings (180D).

For some perspective Hyperliquid trades at 68.66x. Jupiter at 29.48x. Raydium sits at 24.31x.

Pump is valued below the peer average despite being one of the highest revenue generators in DeFi.

3/ The caveat is revenue has cooled down significantly ($134M to $39M).

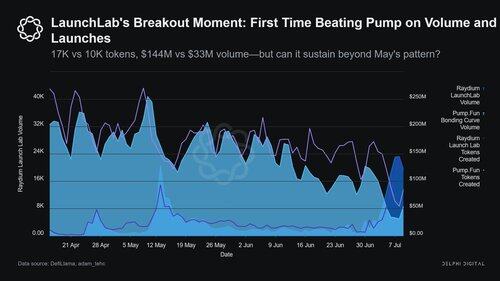

Pump Fun is also losing market share to competitors, going from controlling 70% of new token launches to 20% on Solana as competitors like Raydium LaunchLabs gains traction.

However, even at this collapsed monthly run rate, Pump still generates more revenue than the majority of DeFi protocols.

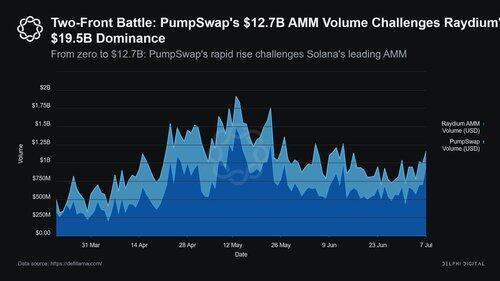

4/ Pump has demonstrated ability to adapt its business model. After moving away from Raydium, PumpSwap now processes $12.7B in monthly volume.

This vertical integration captured $108M in total fees as Pump now controls the entire token lifecycle.

6/ The data shows a clear disconnect. Pump trades at a fraction of its competition. Either the market is correctly pricing future decline, or this represents a significant valuation gap.

Saturday's launch will provide the first real test of whether fundamentals can overcome sentiment.

77,37K

Johtavat

Rankkaus

Suosikit