Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

A deep dive -- a really deep dive some might say -- into the IMF's new External Sector Report.

It is a step in the right direction, but the IMF is still understating the scale of global trade imbalances and the scale of China's surplus.

1/

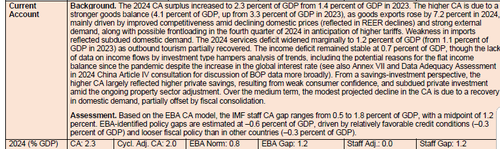

Pierre-Olivier Gourinchas' blog draws attention to how both the US deficit and Chinese surplus widened in 2024 (v 2023) and how this widening was unwelcome as it pushed China's surplus (and the US deficit) above the estimates in the IMF Model

2/

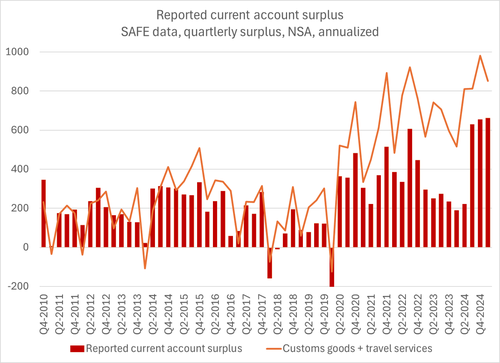

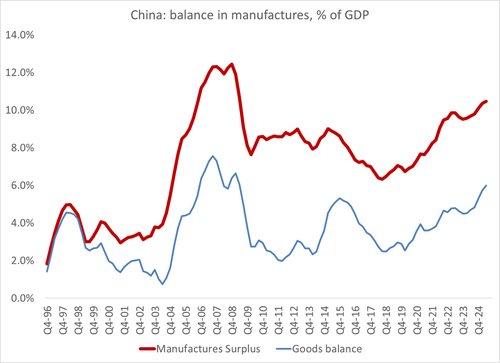

But the IMF is working of China's reported current account surplus of just over 2% of GDP (and the IMF inexplicably forecasts this surplus will fall in 2025 even tho the goods surplus is already up $150b ... )

3/

The forecast $375 billion surplus (1.5 to 2 pp of GDP, or just a bit higher than the IMF's current norm for China) is this WAY to low. If China's post 2021 data wasn't based on internal survey that seems to have been calibrated to zero out errors ...

4/

China's reported surplus would be in the range of $800 billion if not a bit more ... (see the correlation with customs adjusted for tourism in the past)

5/

The IMF does discuss these data issues in Box 1 of chapter 1 -- which is essential reading and covered in depth on my blog. The IMF (wisely) thinks China is obscuring its income balance ...

6/

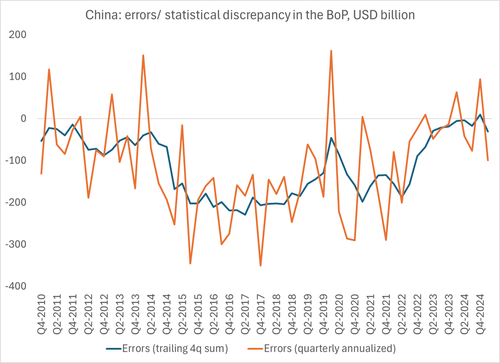

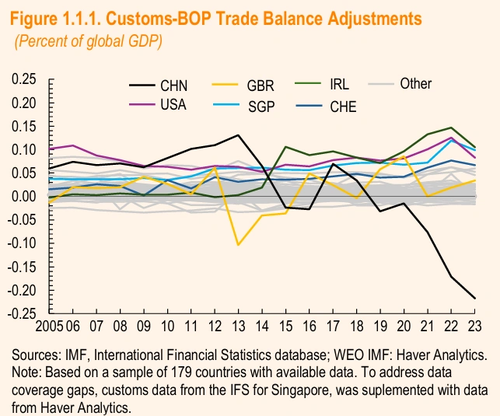

And the IMF's statistics office clearly didn't think through the implications of encouraging countries to use survey data rather than customs data to construct balance of payments goods numbers in the BoP (in the BPM6 standard)

7/

The IMF cannot criticize China for adopting the IMF's suggested methodology, but the chart below shows that it has been a disaster (did the IMF not remember that China's survey based GDP data is massively problematic and seemingly manipulated) ...

8/

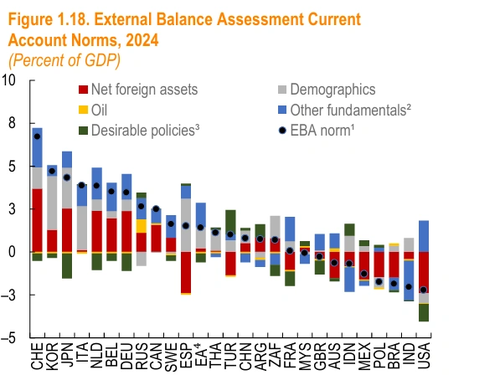

Another interesting technical issue is the role of the IMF's "net foreign asset" variable in the generating the 1% of GDP surplus norm for China and the 2% of GDP deficit norm for the US ...

9/

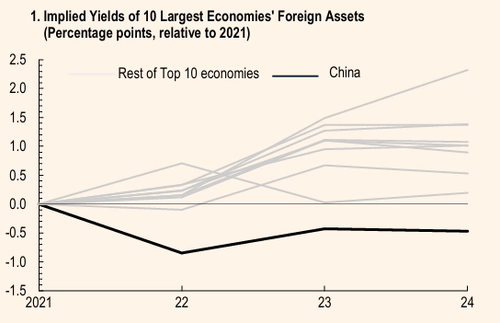

The IMF interprets the net foreign asset variable as a catchall (it more or less captures past surpluses and deficit plus valuation changes) and not in the obvious literal sense as a forecast for the income balance on past surpluses/ deficits ...

10/

But if it is more than a statement that surpluses and deficits are persistent, it should relate at least in part to the income balance, and interestingly, it doesn't for either the US or China ...

11/

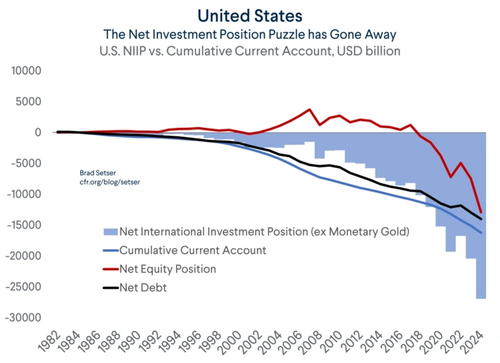

the US has a massive negative stock position (both debt and equity), yet thanks to the big profits American firms report earning in a few tax havens, the income balance is pretty flat -- not the 3% deficit the IMF model arguably forecasts ...

12/

And China has an increasingly positive net international investment position, and thus the IMF model implicitly suggests that most of its current account surplus should be coming from investment income earnings ...

13/

Yet China posts a (ridiculous) deficit in investment income that even the IMF now questions, and its reported external surplus is all from its now massive goods surplus!

14/

Also recommend the comments on the External Sector Report (and the IMF's approach to China more generally) from @sobel_mark

22,96K

Johtavat

Rankkaus

Suosikit