Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

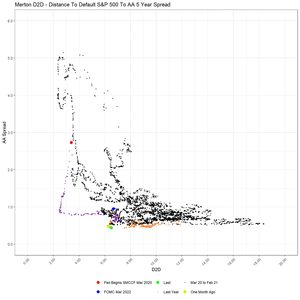

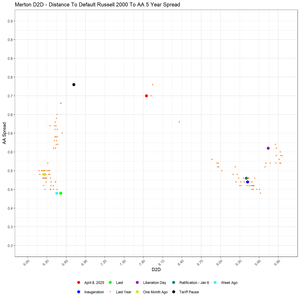

in terms of risk qualified (use Merton "distance to default " D2D - credit spreads tight such that indicates a large regime jump in D2D given rise in SP500 ( about rise of 30% in SP500 to 8000 or so. seems unlikely. or. credit spreads will rise to 1 1/2%, triple spread and SP500 down about 10%.

This market internal structure is fragile and will make very large sudden moves so as to "clear". I think SP500 drops and credit spreads 3X - in short a severe and sudden adverse event.

1,85K

Johtavat

Rankkaus

Suosikit