Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

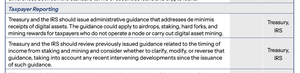

Boop.Fun leading the way with a new launchpad on Solana.

Today the President’s Working Group on Digital Asset Markets released their long awaited report, framing the administration’s goals for crypto policy. Here’s a quick reaction thread focused on Coin Center’s top issues, individual liberty, privacy, and commonsense taxation. 1/

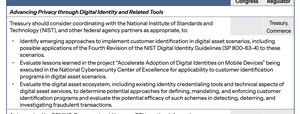

A key Coin Center goal is to maintain the "control"-based division between BSA-obligated entities who must surveil their users vs. non-controlling persons publishing software or providing ancillary services who are unregulated under the BSA. To that end we are thankful for the endorsement of “control” as a key factor in regulation in CLARITY and the included BRCA. 2/

Also on the AML/KYC front, the report suggests the creation of new digital-asset-specific categories of BSA obligated institutions. We did not ask for this policy change and while it could be done well, opening up the definition of financial institution to create new subcategories creates risks that those new categories could be overinclusive. It also would not be technology neutral unlike the current MSB classification which is focused on any person with control over currency or currency substitutes. This is not bad policy per se but it could open the door for bad policymaking and privacy intrusions if we are not careful in how those new categories are defined. Coin Center thinks the existing 2019 FinCEN guidance is sufficient and should simply be codified, e.g. by the BRCA. Also note that the administration’s support for a clear, control-based safe-harbor from the BSA is “particularly for money transmitters.” If they start creating a whole new range of BSA-regulated entities apart from money transmitters it’s unclear whether control would remain their bellwether for defining those new categories; if not, that could be a problem. 3/

A disappointing item is the report’s coverage of the FinCEN CVC Mixing rulemaking. The report punts on offering a firm recommendation here, merely saying that Treasury should consider next steps. Coin Center strongly advocates for the abandonment of that rulemaking or else its significant narrowing. As the original NPRM was drafted, CVC mixing was defined to include all manner of entirely legitimate privacy-preserving activities that crypto users can and should perform, such as avoiding address reuse. By consequence the original NPRM effectively would label as a “primary money laundering concern” the entirely legal and purely domestic activities of ordinary Americans. The report doesn’t advocate for that bad rulemaking but it certainly equivocates as to whether that proposed policy was a mistake and should be dropped before the rule goes final. It was a mistake and should be abandoned. American would hardly be a welcoming home for crypto if the normal and safe way of using it to protect your privacy was classified as a primary money laundering concern. 4/

Another section advocates for a coordinated approach to digital identity that includes leveraging existing digital identity tech from the crypto space. Coin Center is working on this issue area and supports new efforts in standardization if they include smart, privacy-preserving approaches like zero-knowledge proofs and user-sovereign credentials. We’re hopeful that this effort will ultimately lead to an AML/KYC regime that minimizes personal data collection at trusted institutions and restores our Fourth Amendment rights against mass warrantless surveillance of our financial activities. 5/

On the tax front we are happy that the report highlights the need for a de minimis carve out and better treatment of mining and staking. Nonetheless it is disappointing that the administration did not go further and simply call for the rescinding of past bad IRS guidance that has treated newly created property from block rewards as income upon receipt. That bad guidance is why we are supporting Josh Jarret’s lawsuit and efforts in Congress. The administration could make that fight a lot easier by simply rescinding guidance that was wrong from the start: a new bitcoin you mine is not income just as a new ear of corn you grow or book you write is not income. None of those should be taxed until they are sold. 6/

24,25K

Johtavat

Rankkaus

Suosikit