Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Amanda Tuminelli

Executive Director + CLO at @fund_defi. Human to bader the dog. Avid reader of fantasy fiction. Constantly seeking excellent food.

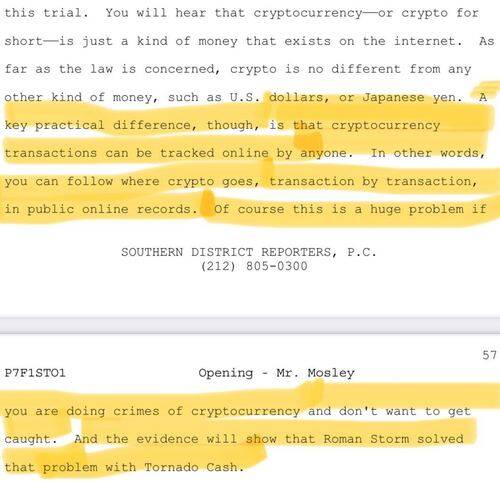

As of Thursday, in their Rule 29 response, the DOJ is still pushing this theory that Storm, by publishing TC software, provided a "valuable service" to a sanctioned entity because DPRK used the protocol. This flawed principle is limitless: if I make a hammer with no particular end user in mind and somehow that hammer ends up being used by DPRK, I provided them a "valuable service."

But you don't see them going after Apple for the iPhone, Google for its tech suite, etc., even though these tech tools are used by the DPRK. That's because this is a gross distortion of the law.

Back when we @fund_defi @jchervinsky wrote our amicus brief in support of @rstormsf's MTD, we reviewed over 100 sanctions cases and provided the court with a table of them - in every single case there was nexus between the sanctioned entity and the defendant, some evidence the defendant directly connected with the SDN or created a tool *for* the SDN specifically. There was no case - none - where a defendant made a tool with no particular end user in mind and was then convicted of violating sanctions because an SDN ended up with that tool in hand.

30.28K

Amanda Tuminelli reposted

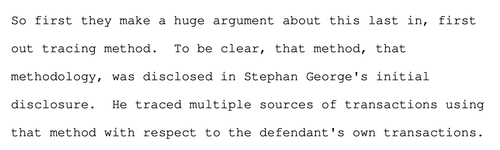

I am very concerned that the courts, these AUSA's prosecuting crypto crime, and the IRS do not seem to understand the difference between using LIFO to:

(1) establish the amount of assets that flowed through a very limited set of KNOWN parties and a very limited set of their KNOWN accounts.

(2) trace $148k through TEN unattributed wallets on the blockchain, each of which do somewhere between $4m in volume and $1.5 billion in volume, to establish that the last wallet in the chain received the victims funds and then sent out the victim's funds to Tornado Cash.

I've never seen anything like this. I've never worked with a single fed who would back a freeze like this. I wouldn't back a freeze like this.

Doing so runs a real risk in freezing an innocent third-party's funds unlawfully. It almost certainly does not impact the actual criminal—the thief, or their money laundering counterparts. Thus, it would not create recourse for the victims of the original crime.

45.08K

Amanda Tuminelli reposted

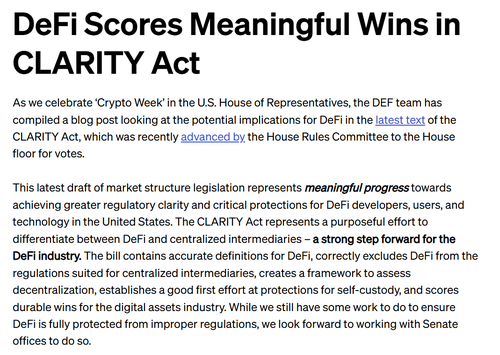

DeFi regulation is a sticking point in the market structure bill debate.

CLARITY passed the House with good but not great protections for DeFi developers. We need to fight for more in the Senate.

This is no time to compromise just to “get a bill done.” Protect DeFi or no deal.

42.17K

Amanda Tuminelli reposted

DeFi *IS* different. Thank you @CongressmanGT for championing DeFi on the House floor:

"Congress is making an unambiguous statement that DeFi is different and it should be treated differently from the centralized, custodial intermediaries. Protecting this emerging technology is an essential purpose of the CLARITY Act."

We could not agree more.

3.46K

Amanda Tuminelli reposted

A few moments ago on the House Floor, @RepFrenchHill acknowledged that "decentralized finance or DeFi developers do not take custody of user assets, nor do they control user assets. Therefore, we should not treat them in the same way we treat centralized actors who do have custody, who do have control over assets."

Thank you Chair Hill for recognizing DeFi's unique characteristics.

20.52K

Top

Ranking

Favorites

Trending onchain

Trending on X

Recent top fundings

Most notable