Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

These two sentences basically summarize Powell's main attitude towards this interest rate decision. Powell is trying to avoid sending any signals about a rate cut. Key points from Powell's press conference today:

1) It is still too early to expect a cut in the federal funds rate in September;

2) Given the uncertainty surrounding tariffs and inflation, the current level of interest rates is appropriate;

3) The impact of policy changes remains uncertain; the effect of tariffs on inflation will be short-term, but the process of tariffs being passed through to prices may be slower than previously expected. However, the impact of tariffs on inflation has already begun to show, but it is still too early to assess the extent of this impact;

4) The job market has not weakened, but there are clear downward pressures in the labor market.

I personally feel that the overall speech was neutral, providing no substantial policy guidance (which may have disappointed some), but it also did not have a tough tone (everyone can look back at Powell's strong statements in the past). It is evident that Powell is caught between external pressures from Trump and internal pressures from Waller and Bowman. At the same time, it was once again clarified that the impact of tariffs on inflation is one-time, but the extent and process of this impact are difficult for the Fed to judge.

I think it is worth noting that Powell mentioned the two dissenters (Waller and Bowman) will explain their opinions in the next couple of days. Normally, the public statements of Fed governors after an interest rate decision are significant and are coordinated by the Fed. The fact that the two dissenters, who support a rate cut, are speaking first about why they support a rate cut, rather than having the hawkish governors explain why they want to maintain the current stance, seems to be Powell's biggest concession to Trump under the guise of defending the Fed's independence.

Jul 30, 2025

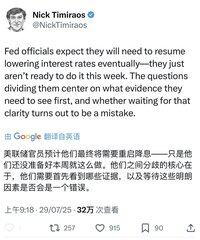

Using Nick's two articles and Steven's tweets to discuss the Federal Reserve's interest rate decision tomorrow morning: 1. It is highly likely that there will be no interest rate cut in July, and the market should have fully anticipated this. However, this time there should be two dissenting votes against the no-cut decision—most likely from the dovish Waller and Bowman. This is also the first time in nearly 30 years that the Federal Reserve's interest rate decision has seen two dissenting votes, indicating divisions within the FOMC.

2. Since inflation has been relatively mild since the second quarter, coupled with the pressure from Trump and Bessen to cut rates, the Fed members also understand that returning to a rate-cutting path in the future is inevitable. However, the reasons for the rate cut are crucial: 1) Should they wait a few more months to see if tariffs indeed have no impact on inflation before making a decision? (It might be too late) Or, as long as inflation does not rebound significantly and the monthly inflation rate does not rise, can they return to cutting rates in the next meeting? 2) Or should they place more weight on employment data: The job growth in June was actually quite poor; excluding government job additions, the private non-farm employment has significantly fallen below expectations. This was also Waller's previous reason for advocating a rate cut. The July employment data, which will be released this Friday, is expected to show an addition of 110,000 jobs, which is significantly lower than June's 140,000 (June was propped up by government jobs). Let's see how Powell addresses this in the press conference.

3. Trump's pressure on the Federal Reserve and his continuous calls for rate cuts will have an increasing impact. If Trump's next nominee for the Federal Reserve becomes clearer, the market will pay more attention to what the future Fed Chair (who will still be the shadow chair until May next year) has to say, as the market always trades on expectations. This is what Nick means when he says, "The Fed's ability to resist Trump may have reached its limit." As previously discussed, as time goes on, when Powell has only half a year or even less left in his term, the power of the "shadow Fed Chair" will grow stronger, and at that point, the market will likely be very concerned about what Powell has to say.

55.21K

Top

Ranking

Favorites