Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Just added to my $GLXY calls on this -11% day following $CORZ's -18% move (a large part of this seems to be driven by the lack of borrow on $CRWV....)

$CRWV <> $CORZ deal was just announced, all equity acquisition (implied ~$9B valuation ~$20/share) it's not closing until Q4 so $CORZ has traded down significantly to $14.85 - big reason for this is that $CRWV borrow costs are insane right now 150-200% annualized, so typically people could buy $CORZ at $15 then short the corresponding amount of $CRWV shares (ratio of 8:1) and lock in a $5/share profit when the deal closes - but it doesn't make sense given insane borrow costs right now.

Overall since this is an all equity deal $GLXY actually benefits because it reduces $CRWV's future cash liabilities (CoreWeave's bonds are up on the day) therefore $GLXY has a higher chance of getting paid.

Still think $GLXY has a ton of exciting catalysts coming in the next 6 months

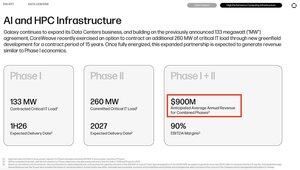

- financing announcement for Helios phase 1/2 (coming imminently)

- approval of another 800MW from ERCOT for Helios bringing total power to 1.6GW (and potentially a new deal/tenant with this)

- still have this extra 200MW that $CRWV could exercise their option on - in terms of the $CORZ deal you could argue either way if it has increased/decreased the likelihood of this happening but I think it ultimately it is a demand question which for data centers is still incredibly strong so either $CRWV takes it or another tenant

- $BTC is also doing very well and Galaxy seems to be announcing more partnerships / exciting projects they are involved in every day!

27.6.2025

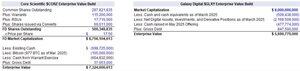

Core Scientific's $CORZ rumored deal with CoreWeave $CRWV should result in a material re-rating of Galaxy Digital's $GLXY shares. $GLXY 's enterprise value ($5.7B) currently represents at a ~20% discount to $CORZ ($7.3B) despite the facts that:

- Galaxy's contracted revenue ($900MM per year) from its CoreWeave lease agreement is larger than Core Scientific's ($850MM)

- The embedded growth in Galaxy's data center business (w/ potential to grow to 2.5GW) is significantly larger than Core Scientific's

- Galaxy owns the only full-stack digital-asset focused financial services platform.

Not only does $GLXY's current valuation imply its data center business is severely undervalued, it also implies you are getting its financial services business for free.

At $17.50 per share for $CORZ (the current price in pre-market trading; note the acquisition price will likely be significantly higher), $CORZ trades at a $7.3B enterprise value. Meanwhile, $GLXY currently trades at a $5.7B enterprise value.

Galaxy's lease agreement with CoreWeave provides for $900MM of avg. annual rent to $GLXY, vs. $850MM for Core Scientific's. CoreWeave would actually save more in annual rent expense by acquiring $GLXY as opposed to $CORZ, which obviously implies that $GLXY is worth more to $CRWV than $CORZ!

Furthermore, Galaxy's lease agreement (393MW critical IT load, 600MW gross) represents under 25% of their total expected power capacity (2.5GW) at their Helios data center campus. Meanwhile, Core Scientific's lease agreement with CoreWeave (590MW critical IT load, 800MW gross) represents the majority of Core Scientific's total expected power capacity. As such, Galaxy's ability to grow its data center capacity well beyond its existing deal with CoreWeave suggests it should trade at a premium to Core Scientific on a per MW of approved power basis, yet it trades at a discount!

Finally, Galaxy possesses a "one-of-one" asset in its digital-asset focused financial services platform. This business, which includes OTC trading and market making for spot and derivatives, investment banking, asset mgmt., and staking, has been consistently profitable since inception, generating over a billion dollars of profits for shareholders! To highlight the historical profitability, consider that $GLXY 's book value per share has compounded from ~$1 in 2018 to $6+ today.

At the current $GLXY valuation, not only are you getting Galaxy's data center business at a fraction of its intrinsic value, you are getting its digital assets business for free.

15,21K

Johtavat

Rankkaus

Suosikit