Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

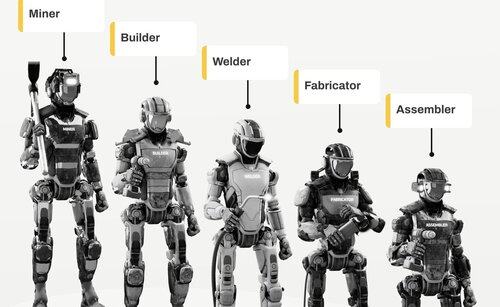

Been exploring early-stage robotics companies recently.

We've all heard of Figure and other big names, but watching what's happening at grassroots level is super interesting.

Here are 11 companies founded since 2023 with < $100m in funding that caught my eye.

Thread: 1/17.

1. Dyna Robotics

Founded in 2023 by Ex-Caper AI founders (sold for $350M) and Jason Ma (ex DeepMind Research Scientist). $23.5M Seed round (March 2025).

Dyna wants to build affordable generalised robot arms. Several live pilots including food prep and laundry.

@DynaRobotics

2. Generalist AI

Founded by Pete Florence (CEO, ex-DeepMind, MIT PhD) & Andy Zeng (ex-DeepMind, 21K+ citations).

Demonstrated capabilities: precision assembly, tool use, dexterous manipulation. Developed end-to-end AI models controlling robots at 100Hz.

@GeneralistAI_

3. Scout AI

Brother of Figure AI's CEO raised $15M for defense robots you control with natural language in GPS-denied zones. Their Fury AI brain is hardware-agnostic and runs on commercial components. Multiple DoD contracts already secured.

@ScoutAI_

4. Sunrise Robotics

Slovenian team raised $8.5M to make AI-powered industrial robot workstations. From formation to deployed customers in 18 months.

Simulation-trained robots. 10x faster and cheaper deployment than traditional automation.

@sunriserobots

5. The Robot Learning Company

Solo founder creating affordable general-purpose robots as alternative to $100K+ custom automation. Focusing on stationary, repetitive tasks.

Very early, founded in 2025 and part of YC's X25 batch.

@RobotLearningCo

6. Zeon Systems

YC startup developing AI-powered lab automation with natural language interface.

Vision is to Accelerate scientific research through intelligent automation. Active deployments at Stanford and UCSF labs.

@zeonsystems

7. Lumos Robotics

Founded in 2024 in Shenzen. Raised $28m so far.

Aiming production robots in 2025 with rapid development of a touch‑centric humanoid stack. Combining visuotactile hardware, an imitation‑learning brain and a tightly‑integrated supply chain.

@LumosRobotics

8. RIVR

ETH Zurich spinout with $22M funding from Jeff Bezos and others.

Wheel‑legged robot that can sprint 22 km/h on pavement, carry 60–85 kg up stairs, and hand parcels off at the door. Differentiated from existing low‑payload sidewalk delivery robots.

@rivr_tech

9. Persona AI

Ex-NASA Valkyrie team raised $27M pre-seed (May 2025) to build the "F-150 of humanoids" - rugged 5'8" robots for "dull, dirty and dangerous jobs". Signed with the world's largest shipbuilder for deployment in 18 months.

No fancy video here yet.

@personaaiinc

10. Genesis AI

$105M seed (!) (July 2024) from Khosla/Eric Schmidt etc for a robotics focused foundation model.

Fuses real-world robot trials, high-fidelity physics sim & internet-scale embodied data into a single engine.

Still in stealth but one to watch.

11. The Bot Company

The Bot Company (founded 2024) is a $300M‑funded startup by ex‑Cruise founders (autonomous vehicle company acquired by GM for $1B+).

Building affordable, non‑humanoid home robots (mobile base + grippers).

Over my $100m limit but still intriguing.

Summary and Insights

I could write 10x on most of these projects, and my takeaways are too long to fit into Tweet format. Perhaps I'll write a report on @delphi_intel if @PonderingDurian and @anildelphi are game.

But nevertheless here are some top takeaways:

1. Specialised vs generalised

Companies starting specialised are reaching revenue faster (Dyna has paying customers, Scout has DoD contracts), while generalist companies have raised more capital but are further from revenue.

2. Humanoid vs arm

Persona AI chose humanoid specifically for shipyards because the environment is designed for humans.

Others such as Dyna chose arms as they can be produced significantly cheaper while being more effective at certain tasks.

"Robot dogs" ala Rivr also common.

3. Data

Virtual enviroments seem to be a common trend, where many thousands or millions of simulation runs can take place in various generated virtual enviroments to produce dynthetic data on which RL can occur to train motor skills

These are relatively early stage companies, but later stage companies like 1k Technologies, Figure and Apptronik are perhaps even more interesting.

Let me know if there's any interest in a thread or report on those.

2,56K

Johtavat

Rankkaus

Suosikit