Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

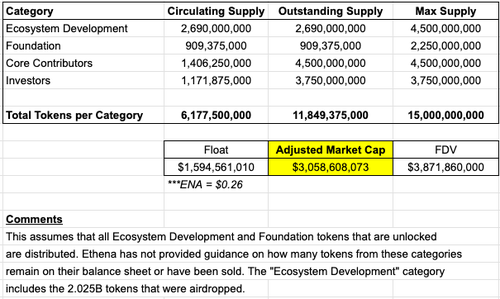

1/ It's time to put a stop to the crypto industry's use of MC and FDV for valuing token projects. These two metrics do very little to accurately represent the valuation of a project and instead we propose a third metric in the middle: Adjusted Market Cap. Breakdown below👇

2/ Adjusted Market Cap better captures token valuation as it simply includes not just tokens that are circulating in the wild, but tokens that are also held by insiders like VCs and team members, which have an unlock date for distribution.

3/ Tokens that are owned internally by a project, if not earmarked for anything, even if they are "unlocked" are not part of the Adjusted Market Cap, only part of the FDV. The Float is the most narrow definition and only includes tokens tradable on the market.

4/ Here's an example using Ethena's $ENA token. Although unlocks on Investor and Team token allocations have been partially distributed, we know these eventually will hit the market, so they are counted under Adjusted Market Cap.

5/ Of note, we don't actually know how much of Ethena's Ecosystem Development and Foundation allocation have been sold or earmarked for sale. We know that 2.025B has been distributed over 3 seasons of rewards farming, but that only represents about half of these categories.

6/ In a perfect world, Ethena would provide standardized reporting that discusses how many tokens are still on its balance sheet and how many were spent in a given period and on what.

8/ Read our full post with more examples here

7,44K

Johtavat

Rankkaus

Suosikit