Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

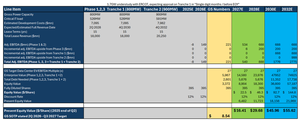

Okay some bullish moon math if $GLXY gets its next 1.7GW approved at Helios and they can contract out the full 2.5GW with a similar deal to the current $CRWV lease.

Looking at $92/share in 2030, and $145/share in 2032, discounted back to today at a 12% rate that is $46 / $55 for Helios alone!

Note this doesn't account for Galaxy's balance sheet of ~$3B in crypto, crypto infra/VC investments and cash + their extensive crypto business lines & subsidiaries/JV's (like @GK8_Security & @AllUnityStable).

1.8. klo 02.19

Goldman just dropped a great research piece on $GLXY! Here is my take (TLDR very bullish $GLXY's data center business, discounting back 2028E numbers, the first 800MW at Helios alone should contribute ~$30/share to $GLXY).

Coverage has started! Upon first look Goldman's $30 price target on Galaxy feels a very underwhelming but digging into their report and assumptions I am feeling extremely bullish... it is a complete vindication of @RHouseResearch's report on $GLXY's Data Center Business (EV/EBITDA multiples Goldman uses are actually even more bullish).

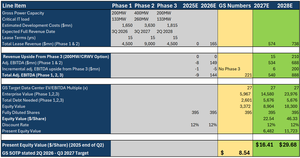

Okay so looking at Goldmans SOTP of Galaxy, just focusing in on the data center business for now, they arrive at an implied enterprise value of ~$5.9B in 3Q 2026- 2Q 2027, less 2.6B in debt = ~3.4B in equity value ~$8.6/share - I show this in yellow in the table below.

For some reason Goldman chooses 3Q 2026 - 2Q 2026 to back out their numbers from... and does not assume $CRWV will exercise their 200MW option (Phase 3) or get any of the additional 1.7GW they have understudy approved/contracted out (overly punitive in my view given comments from management).

Instead in the table below what I do is lay out a more realistic case and assume that $CRWV does exercise their additional 200MW (which we could see as soon as August 5th earnings but as late as Sept, when the option expires).

From here I discounted back the EBITDA from 2027E / 2028E when Phase 1/2/3 should fully ramp in terms of buildout and cashflows.

Doing this (using Goldman's 12% discount rate + suggested 27x EV/EBTIDA multiple for the data center business) we get a present value of $16.41/share discounting back from 2027E and $29.68/share discounting back from 2028E (highlighted in green).

This is 2-4x what Goldman has in their sum of the parts valuation using all their same assumptions but adding in that $CRWV will indeed take the extra 200MW option or $GLXY will lease it out on similar terms.

Note that discounting back Equity Value from the 800MW of power that Galaxy has approved from 2028E contributes a whopping $30/share in equity value, this is roughly the current market cap. This DOES NOT include the balance sheet, crypto business lines, joint ventures or the full potential of Galaxy's data center business given they still have 1.7GW under study that could be leased out + are looking at 40 different $BTC mining sites to acquire and convert into AI data centers. I will do a future post on this with a full SOTP analysis which should get us much closer or exceed my $100/share target!

20,61K

Johtavat

Rankkaus

Suosikit