Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

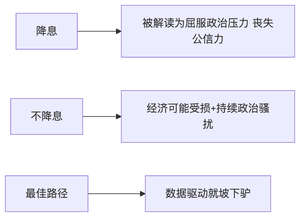

Trump is currently making a big deal out of firing Powell. Although everyone is very clear that he cannot achieve his goals through normal means, he continues to torment Powell and market confidence with unconventional tactics like the overspending on the Federal Reserve's headquarters renovation. For him, whether Powell continues to serve is not important; what he wants is simply the result of interest rate cuts. However, his unconventional methods have put the Federal Reserve in a dilemma: if they cut rates, their independence is lost; if they don't cut, the turmoil continues. So the best path might be for the data to perform well, and the Fed to ease off.

When Trump announced yesterday that he wanted to fire Powell, gold and U.S. Treasury yields initially surged, but when he saw the market's poor reaction, he quickly backtracked. It is still unclear whether Trump is using a TACO strategy to constantly test the market's bottom line or if he is retracting upon seeing unfavorable conditions. However, Wall Street bigwigs like Jamie Dimon of JPMorgan, David Solomon of Goldman Sachs, Brian Moynihan of Bank of America, and Jane Fraser of Citigroup are all voicing support for the Federal Reserve, while the market is gradually becoming desensitized. After all, everyone knows that a rate cut will inevitably lead to a decline in the dollar index and an increase in Treasury yields, so it is necessary to prepare in advance. Trump is more likely to be asking for a sky-high price and then paying on the spot; he started by calling for a 50 basis point cut and then said a three percentage point cut was needed, but his ultimate goal is just to cut by 50 basis points this year.

From a policy perspective, the time window for rate cuts is also very tight. The rebound in Tuesday's CPI data shows that, after three months, tariffs have finally impacted prices, but the tariff war in April only lasted a week from 4.2 to 4.9 before being suspended. If the new round of tariffs starting on August 1st is not TACO and is implemented seriously, inflation may rebound significantly in November, leaving no room for rate cuts. Therefore, the conflict between Trump and Powell has tightly constrained the time window for both rate cuts and tariffs. If the Fed does not cut rates in September and drags it to November, it will be very difficult to cut rates this year. Either Trump has to abandon the tariff policy, or the Fed has to give up its independence; wanting both is too difficult.

Whether rate cuts are good or bad for the cryptocurrency market is actually quite complex and needs to be discussed in different situations and stages. At the first moment of a rate cut, international arbitrage funds that have piled into U.S. Treasuries and stocks to earn interest differentials may withdraw, but the domestic liquidity brought by the rate cut will also enter the market, completing a process of changing the main players. Since the large institutional funds driving the rise of cryptocurrencies are mainly domestic U.S. funds, there may be a wave of decline during the panic of fund withdrawal, but once stabilized, the internal driving force will still support a long bull trend. Trump's pressure is short-term noise, but the independence of the Fed and tariff inflation are the core variables.

14.7. klo 01.14

The Hassett Nick is talking about is Kevin Hassett, one of the two Kevin contested for the Fed chair mentioned in Article 7.9 (the other is former Fed Governor Kevin Warsh). He is a core member of Chuanzi's economic team, a first-term veteran, and although he is not as famous as Bethson, he is deeply trusted.

Nick's frequent voice for the Fed's renovation in the past two days seems to be too intensive, maybe Powell is under more pressure than we see, so he is very anxious.

Assuming that Powell is really forced to resign under pressure, it is actually a relief for him personally, neither does he have to be nagged by Trump every day, and no matter how the market goes, he can't dump the blame on him.

If Powell really resigns within two weeks, the subsequent market will begin to ferment doubts about the independence of the Federal Reserve, coupled with the fact that the U.S. stock market is now at a high level, and it can also be superimposed on the August 1 tariff to create panic. In this way, I'm afraid that the Trump family has already opened a short order? After the short order is earned, push a new chairman to come up and cut interest rates urgently, and then eat a long order?

25,99K

Johtavat

Rankkaus

Suosikit