Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

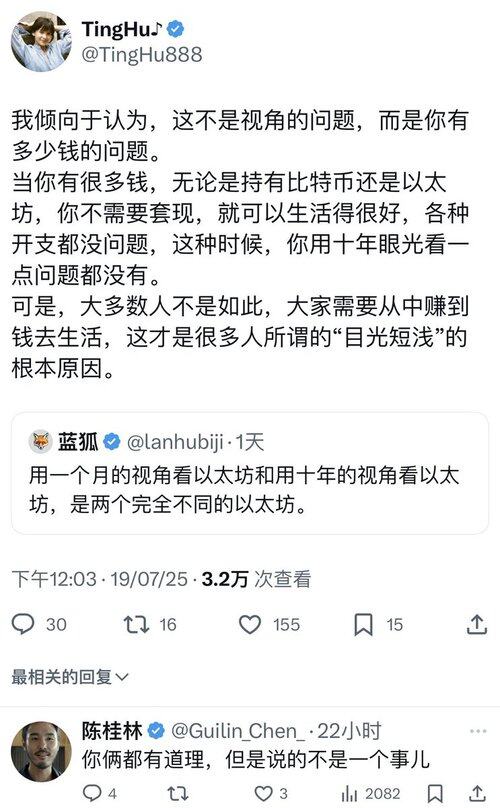

From the perspectives of assets, funds, and time dimensions, the wonderful discussion by the three teachers is captured in the screenshot below, which puts their viewpoints together. This is very similar to @Guilin_Chen_ 桂林's viewpoint, and both @lanhubiji 蓝狐 and @TingHu888 T大 have made very reasonable points; in fact, the two are looking at it from different angles: the former from the asset perspective, and the latter from the fund perspective.

What is the asset perspective? The core is to think about how the fundamentals of this asset (stock or coin) are? What is its growth potential (the state of its business and ecosystem development and growth rate)? Can it ensure continuous growth over three, five, or even ten years, and can it maintain a leading ecological position in the industry?

This also needs to be tracked dynamically: 1) The situation in the next one or two years may change in the next three to five years (from high-speed growth to stable development); 2) Or it may not perform well in the next one or two years, but because its core capabilities remain, with the right strategy and timing, it may perform well again after one or two years (turnaround from adversity).

What is the fund perspective? It refers to the nature of the funds and the length of the cycle.

For individual investors, is this investment fund going to be used for emergencies in the future, or is it not needed in the short term (within half a year to a year), or does it not affect life even if it incurs losses? This determines our mindset, rhythm, and how we view the asset's short and long-term perspectives.

Just like in institutions, the decision-making cycles, action rhythms, and perspectives of hedge funds (such as Castle, Millennium, etc.) and ultra-long-term long-only funds (such as Baillie Gifford) are completely different: hedge funds need to report performance to investors every month, and if their performance is poor for six months to a year, they may face significant withdrawals from investors; long-term or ultra-long-term funds do not face this issue constantly, so they can think longer-term and withstand volatility better (provided they have accurate judgments about the assets).

This leads us to the third dimension: the time dimension. This is viewed from the investment and trading behavior itself. The fund perspective discussed above, in my opinion, is more of an external constraint, while the time dimension is more about personal choice, which is what rhythm we prefer. Some are obsessed with short-term trading, some like to ride trends, and some prefer long-term holding. In "The Professional Speculator's Guide".

28.2.2024

Investing is a game of confidence, and confidence comes from a high degree of certainty about the future potential of the investment. This certainty is derived from a deep analysis of the sector, the position one is in, business progress, the team, and even emotional premiums.

Trading, on the other hand, is a game of discipline. Discipline comes from understanding human nature; when a signal is generated within your trading system, you must enter the market, and when it reaches the take-profit or stop-loss level, you must exit. Violating the system can easily disrupt your mindset, turning small victories into significant wins.

Both investing and trading are fundamentally about probability; there’s no guarantee that any single move will be 100% successful. It’s a comprehensive consideration of four factors: win rate (how high?), odds (how large?), slope (how long is the time period?), and position size (what proportion?).

A good philosophy should be:

Correct direction, build confidence, withstand volatility, and take profits at the right time. Each step is a test.

108,79K

Johtavat

Rankkaus

Suosikit