Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Stablecoins are the Trojan Horse.

Private equity is crypto's real chance to disrupt traditional markets.

While public markets attract a lot of attention, the majority of businesses are in private hands.

64% of all companies generating between $100M and $500M in revenue are private.

This number goes up to 84% for $100M+ revenue companies.

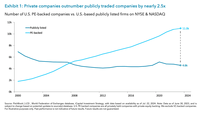

There are approximately 11,000 private equity-backed companies compared to just 4,600 public companies listed in the U.S.

140% more.

So, it's safe to say private markets dominate the investment landscape.

And retail is excluded from all this.

If I asked you to buy shares of SpaceX, most of you would have no idea how to do it.

The same goes for OpenAI, Stripe, robotics companies, etc.

(Luckily, I do. Stay tuned until the end to understand how.)

Regulations introduced over the past two decades have made it more difficult for companies to go public, incentivizing them to stay private longer and create tremendous value in that time.

The data on global stock market listings shows it clearly:

• London Stock Exchange: -75% since 1960s

• Frankfurt Stock Exchange: -40% since 2007

• U.S. Stock Exchanges: -40% since 1996

Over the past 20 years, the number of U.S. publicly traded companies has nearly halved.

Another key factor is that, compared to 20 years ago, companies have a much larger pool of financing alternatives to turn to when they need money.

Two examples make this point evident:

1. Amazon's entry into the stock market in 1997, less than two years after it opened its online store.

2. OpenAI raising billions of dollars from private investors without having to consider an IPO.

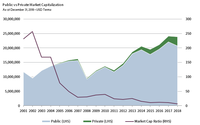

As a result, almost all of the wealth created by today's unicorns has been captured by the private markets.

According to a research by Cambridge Associates, most of the value backed by VCs is realized before the IPO, “often by more than 85-90 percent, highlighting why accessing private-stage equity is so critical.”

You can see that in the chart below, showing how private valuations across all funding stages have increased significantly over the past two decades.

To summarize, the investment landscape is being disrupted: private investments are now a critical component of any institution's portfolio.

And these opportunities remain exclusive to big investors, locking out retail.

In fact, in most legislations, to access investments such as pre-IPO companies, you must prove your status as an accredited investor, which requires an annual income of at least $200,000, a net worth of more than $1 million, or a professional license.

Otherwise, you must run a venture capital fund ($1-10 million minimum) or a private equity fund ($5-25 million minimum).

🌐 TOKENIZATION FIXES THIS

I know, it sounds like a clichè.

But, when it comes to private equity, it really is true.

Tokenization could truly redefine how the whole sector works.

In a recent podcast, @vladtenev outlined a very interesting point about private markets and tokenization.

He outlined the “reverse selection problem”:

“The best companies have a lot of options; they can raise money from anywhere, so they don’t consider retail."

"The only companies tapping into retail are those that have no other options."

Tokenization must succeed to flip the script and open the best investment opportunities to retail.

Luckily, we’ve seen a surge in interest for the whole vertical since the Robinhood and Republic announcements, but I don’t think any of these big players will actually bring private equity access to retail (at least not in the short term).

They’re simply too big; every move they make draws immediate attention from regulators.

Just look at how quickly OpenAI pushed back on Robinhood’s “OpenAI” tokens, and consequently, the EU investigating them for that.

This opens a huge gap in the market, and I think a project is ready to fill it.

@JarsyInc

I first mentioned Jarsy back in April, when almost no one had heard of it.

Since then, I’ve spoken with the team a lot, and they’re absolute killers.

(Not going to dive into their backgrounds and backers, but suggest you look them up).

After seeing users 10x their investment on $CRCL by buying it pre-IPO for $25/share, I got more confident about their PMF, and here I am talking about them again.

In this case, Jarsy is using crypto infra to open up private markets to the public.

Crypto is being used to democratize investing.

Suggest you check out the platform. It's invite-only, so you can use this code to sign up:

q5xuip

(I'm not being compensated for writing this in any way, and I'm not earning anything from the invite code.)

Markets are changing and steadily moving in favor of big and established players.

Crypto, particularly tokenization, is our chance to democratize investing and balance things out.

Being able to invest in SpaceX, Stripe, Kraken, and others while they're private is a huge opportunity to diversify from alts and BTC (especially now that we're deep into the cycle), while still chasing returns you won’t find anywhere else.

6,46K

Johtavat

Rankkaus

Suosikit