Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

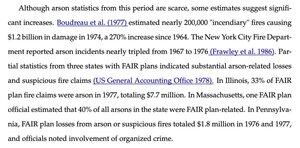

Interesting, highly relevant. What happens when states force home insurers to do things that aren't in their interest (like premium caps, prohibitions of underwriting conditions) etc.

Hartley et al: effects of Fair Access to Insurance Requirements in the 1960s. 1/

The problem: it was hard to get home insurance in some neighborhoods, esp poor, black.

The usual "we have a hammer" solution: FAIR plans banned insurers from using property information and risks to set premia.

What could go wrong? And we know better now, right? 2/

Incredible case of unintended consequences if true: guaranteed insurance meant you could insure properties for way more than their worth, and then let them burn down. 3/

FAIR plans were implemented in 26 states:

- prohibited use of environmental and neighborhood factors in underwriting (!!)

- Mandary insurer partiicpation

- Payout requirements which were well above market values in declining neighborhoods

4/

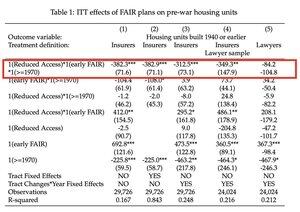

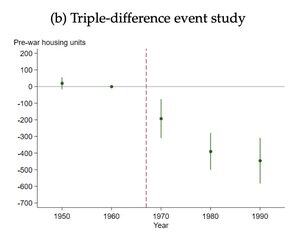

Paper is a triple-difference design, comparing:

- pre/post FAIR implementation

- Neighborhoods with/without likely FAIR access

- Participating / non-participating states

Seems reasonable. 5/

Results are 🔥🔥

FAIR-insured census tracts lost hundreds of housing units between 1960–80, or *about 29.8% the 1950 stock*.

This should be the textbook case for moral hazard, the aggregate losses here are incredible, not to mention effects on neighborhoods. 6/

These were declining neighborhoods already (which is why their insured value was >> market value).

Mandating generous insurance for these properties accelerated their decline by making the insurance payout way more valuable thatn staying and making it work. 7/

4,88K

Johtavat

Rankkaus

Suosikit