Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

1/ Wall Street's math wizards are scratching their heads as quant hedge funds bleed cash in a summer slump that defies explanation.

Let's get into it.

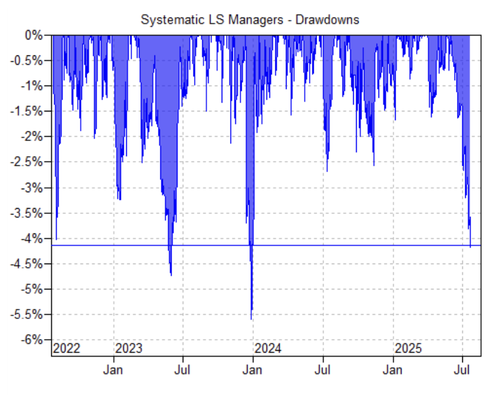

2/ Since June, quant hedge funds like Qube, Cubist (Point72), and Man Group have been hit by an unusual string of steady losses, without a major market shock to blame.

3/ Qube's flagship fund dropped 5% in July, while its larger Torus fund slid 7%.

Both are still up double digits for the year.

4/ Point72's Cubist unit is suffering one of its worst periods since the March 2020 pandemic crash, insiders say.

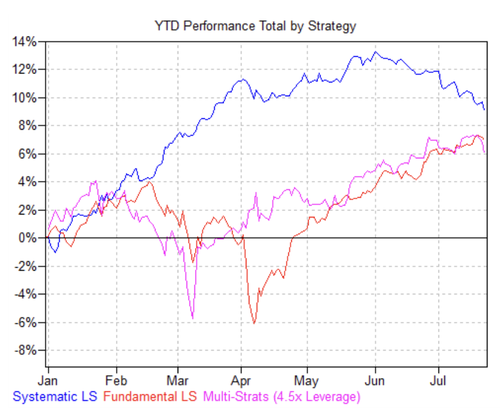

5/ Goldman Sachs data shows equity quant funds lost 4.2% from early June through July 22.

That makes it the worst performance for systematic long-short strategies since late 2023.

6/ Meanwhile, the S&P 500 is up nearly 8% in the same time, and volatility (VIX) is low.

It's leaving many managers baffled by their underperformance.

7/ Unlike previous quant meltdowns, this one is death by paper cuts: small, consistent losses rather than sharp, sudden drops.

8/ Theories range from momentum strategy misfires to speculative rallies and "unwinding of crowded trades," per Goldman data.

But no clear culprit has emerged.

9/ Renaissance Technologies, Man Group's AHL Dimension, and Two Sigma's Spectrum fund have all reported losses in recent weeks.

10/ The slow bleed is fraying nerves in the quant world, where survival now hinges on who has the stomach to stick to their models.

11/ If you enjoyed this thread, follow us @MorningBrew

We post business breakdowns like this 2x a week.

Source:

118,35K

Johtavat

Rankkaus

Suosikit