Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The US stocks market mojo continues to be shared by the rest of the world, with the MSCI ACWI ex-US index making another new high in both USD and local currency terms. Breadth is respectable at 68%. The Mag 7’s dominance notwithstanding, investors are fishing from a much bigger (global) pond these days, which is a good thing.

Emerging market equities have caught a strong bid as well, both including and excluding China. The performance of EM equities is correlated to the commodity cycle (bottom panel), and both have swung up in recent months.

MSCI ACWI ex-US index is trading at a 14.3x multiple. As compelling as that seems, those P/E ratios are at different levels for a reason. The 10-year earnings CAGR of the MSCI US index is 7.8%, which is more than double than the 3.1% CAGR for the ACWI ex-US index.

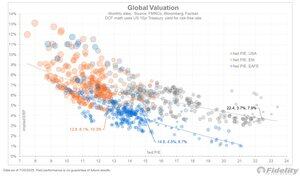

Perhaps a better way to look at valuation is through the lens of the discounted cashflow model (DCF). Below we see the “required return” for the US, EAFE, and EM. The required return is simply the internal rate of return IRR) that is implied based on the current price level, and assuming a growth rate for the earnings payout (dividends plus buybacks). For this example, I am using the 10-year CAGR. From there, we can subtract the risk-free rate to arrive at the implied equity risk premium (iERP).

In the chart we see that at its current level, US equities are trading at a 7.9% required return while EAFE trades at 8.7% and EM at 10.3%. How much is that worth? If EAFE were to trade at the required return that the US is trading at (or the other way around), it would add 18% in relative performance (1800 bps). So, if we are entering a new era of deglobalization and de-dollarization in which the US loses some of its supremacy premium and the playing field levels out, then there is 1800 bps of alpha to be harvested in terms of relative performance. Worth playing for, even if it’s only half that.

Looking at this another way, below I show a scatter plot of the implied ERP and fwd P/E. They are of course correlated. While the US is trading all the way at the lower right tail (high P/E and low iERP), both EAFE and EM are trading in the middle of their historical range. In other words, international equities are not only cheap relative to US equities, they are also cheap relative to their own history.

19,31K

Johtavat

Rankkaus

Suosikit