Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Recently, I have swiped a lot of Twitter, and almost most of them feel that the existence of stablecoins is to help US bonds do a split. But in fact, many people misunderstand the core motivation of stablecoin legislation. It is not intended to "solve the U.S. debt dilemma", but is only a branch channel in the U.S. bond buying path.

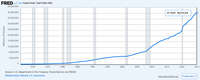

From the data. The current global stablecoin market capitalization is about $200 billion, while the U.S. federal debt has reached $36.2 trillion in Q1 2025. Even if the stablecoin market increases 10 times in the future, the scale will only be 2 trillion yuan, accounting for only 5.5%. Therefore, the so-called "stablecoins to save U.S. debt" is not true at all in terms of magnitude. And 10 times this is also a false proposition. The passage of the stablecoin bill will not significantly boost the number of users or market capitalization of USDT/USDC. the demand for compliance ≠ exploded; Those who should use it will still use it, and those who don't use it will still wait and see; What has really changed after compliance is that the fiat currency acceptance bridge between the US dollar and crypto is more stable.

From the perspective of the problem of the US debt itself. The real pressure on U.S. Treasuries does not come from a "lack of buying", but from a structural trust deficit: uncertainty about the long-term credit of the dollar has risen, and investors are demanding higher interest rates to take over. In fact, buying US bonds is not a problem now, and investors only want more returns to ensure that he has enough profit and loss ratio. Therefore, stablecoins cannot solve these deep contradictions.

From the perspective of demand scenarios. The real "demand scenario" for stablecoins is concentrated in countries with foreign exchange restrictions. For example, in markets such as China, Argentina, and Turkey, users tend to use USDT/USDC to bypass their home restrictions due to capital controls.

However, in areas where sovereign currencies are freely circulating such as Japan, South Korea, and the European Union, U.S. bonds can be purchased with local currencies without the need for stablecoin transfer.

Therefore, the core purpose of stablecoin legislation is not to expand the group of U.S. bond buyers, but to:

(1) Inject a "compliance coat" into the US dollar stablecoin to block the risk of "hidden escape" of the US dollar;

(2) Include USDC, USDT, etc. in the regulatory vision to improve controllability;

(3) Prevent BTC/crypto assets from becoming a "gray channel" for the decentralized circulation of the US dollar.

So, let's summarize. The stablecoin bill has not brought about an explosion of demand for U.S. Treasuries, but an extension of the regulatory boundaries of the U.S. dollar. It gives people who originally had no access to U.S. bonds one more opportunity to buy. Fly legs are also meat~

1,14K

Johtavat

Rankkaus

Suosikit