Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

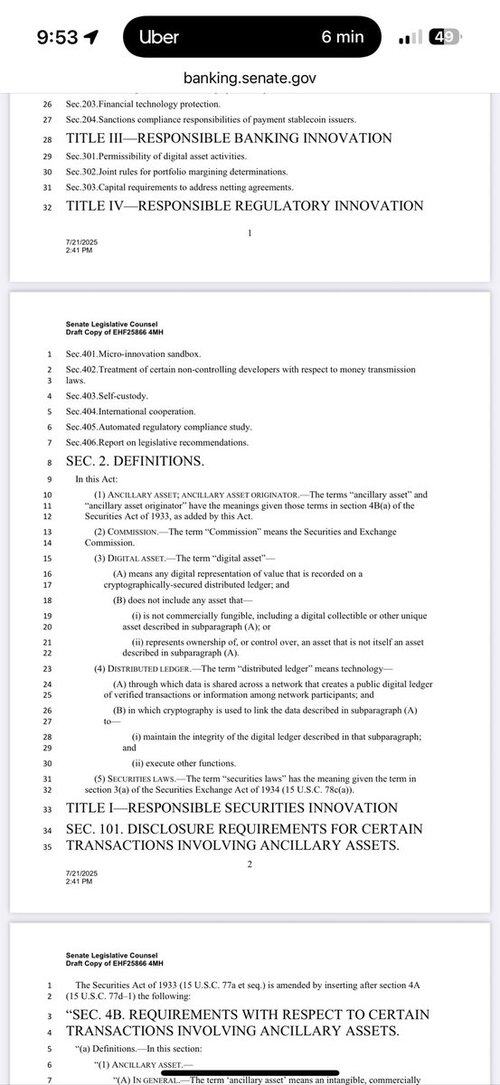

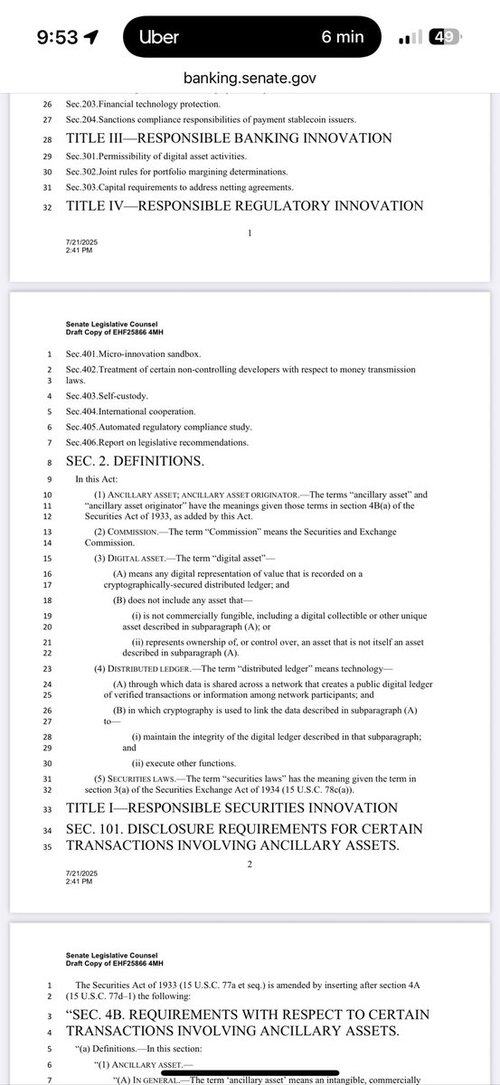

35 pages only. Well this will be a fast analysis. I’ll just hit the highlights.

22.7. klo 21.26

Today, @SenatorTimScott, @berniemoreno, @SenatorHagerty and I led our colleagues in releasing the discussion draft for market structure legislation that will serve as the foundation for making the U.S. the crypto capital of the world.

For those of you who want the see the base text, it’s here. Reminder this is just a discussion draft, and will be somewhat different from whatever version gets marked up by Banking & Ag committees.

First, as usually, we start with the definitions, which is a single decision, page and really just two terms: ancillary assets and distributed ledger.

This just says a digital asset is any digital representation of value on a cryptographic ledger that isn’t commercially fungible or represents ownership or control of an asset that isn’t itself a digital representation of value on a cryptographic ledger.

This is very straightforward and very clean. It’s taking the idea that’s been fought the most about - what are tokens at base if not securities - and saying these are not securities.

It’s the equivalent of Alexander slicing through the Gordian Knot with his sword. It’s workable.

At the same time, recognize what this isn’t: it’s not saying that tokenizing a share of stock transmutes that share into a non-security. Ancillary assets are things which don’t give ownership rights after all. They are different than securities that way, which is the core idea.

Next we have distributed ledger technology and it’s what you would expect, but defines it as a public ledger.

Note: the only Commission listed here is the SEC because this bill only covers the SEC (Banking has jurisdiction over SEC, Agriculture has jurisdiction over CFTC).

To take a further beat on this, this is an effort by the committee to make clear ancillary assets aren’t some supergroup of the best aspects of all financial assets, but that they come with real costs. You aren’t getting things that exist in securities because these are different assets. That should ward off the idea that every security issuer will want to turn their stock into an ancillary asset, as it’s far from a costless transition.

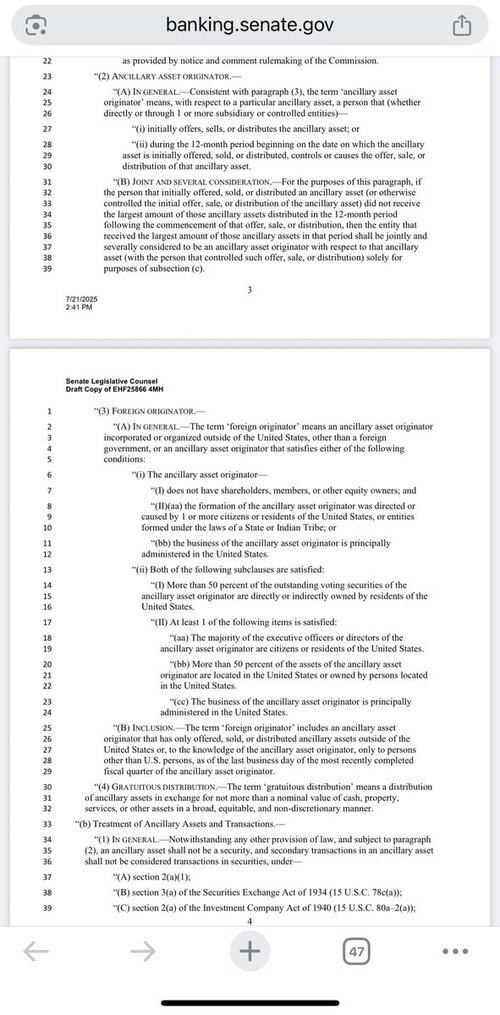

We then have ancillary asset originator. This definition is both broader and narrower than I would’ve expected. It covers the original offerer/seller but also anyone who helped sell or control it in the first 12 months. Is this meant to cover influencers? What about VCs?

We then have foreign originators, which seems to be an attempt to cover companies that are not in the US, not native American tribes, not formed under US laws, or has only offered assets outside the US.

I think this is an effort to solve the on-shore/off-shore dilemma.

Next we have the explicit carveout that ancillary assets are not securities and not covered by the securities laws, federal as well as state.

It also requires that originators self-certify other SEC that they don’t offer one of the rights that ancillary assets may not grant. 9

By the way, the “gratuitous distribution” language at the bottom of pages 4 & 5 seems to cover airdrops. Basically, airdrops (nominal value distributions of ancillary assets) also aren’t securities.

What is nominal though? That’s for SEC to decide via regulations. 10

Finally, with subsection (c), we come to the actual purpose of this section: the disclosure regime.

Periodic disclosures of information will be required if:

- an ancillary asset sold more then $5 million in its first year

- an ancillary assets may had less than $5 million in daily aggregate spot trading over the past 12 months.

Let’s be clear: almost any token of note is going to hit this number, which is the same level as the cap on the crowdfunding regulation.

If you wanted to force some disclosure requirements to the SEC on crypto, congrats, you’ve gotten your wish.

This also applies to existing tokens at the date this becomes law, per c(3). 11

That said, the actual information required for disclosure is different than in traditional securities: it’s information that goes to what a buyer of a token actually wants:

- experience of originator developing digital assets

- prior issuance of digital assets

- future plans for the ancillary asset by the originator

- short discussion of assets and liabilities of the originator

- current legal proceedings involving the originator

- information on transactions involving the originator and related persons, promoters, employees, including ongoing obligations

- past four years of sales by the originator

- a statement in good faith by the CFO that the originator expects to have the resources to remain in business for the next 12 months

- economic information about the asset and its network, including functionality, competing assets, governance mechanisms, and the like. 13

If you’re someone angry that crypto doesn’t do SEC disclosures under CLARITY, congrats, this basically answers all your prayers. It’s frankly similar to what former Chair Gensler mused about in 21 and 22 in terms of creating a special system of disclosures for crypto.

These disclosures continue until the originator certifies they are only doing a nominal amount of entrepreneurial or managerial efforts that “primarily” determined the value of the ancillary asset over the last 12 months, and the SEC approves or fails to rebut the certification. Most tokens will never clear this.

Failure by the originator to follow this section doesn’t make the asset a security though. There are no secret trap cards here of SEC jurisdiction. 15

Of course, there are some additional wrinkles.

- The SEC can exempt an originator from the specified disclosure requirements for good cause

- Originators still face liability for false statements in their disclosures

- Private rights of action are protected

- There’s safe harbor from liability for good faith forward-looking statements that prove inaccurate.

And that’s the end of Section 101, which is the heart, lungs, and brain of this bill.

16

Section 102 covers exemptive authority from SEC registration for ancillary assets. Basically, the cap will be annual sales of under $75 million each year, but SEC can change the level. This probably gets dumped for a CFTC registration process in final bill, but states are preempted (subsection d). 17

Section 103 covers treatment of related persons, such as executives of an originator, employees, promoters, or anyone who controls more than 5% of an ancillary asset IF they bought from the originator or someone acting in originator’s behalf.

SEC will set rules on sales before the ancillary asset is deemed to be no longer under common control. So this is functionally pretty similar to CLARITY. 17

Section 104 requires the SEC to issue a rule within a year of enactment that an ancillary asset that gets its value from a network isn’t a financial interest in anything else.

Section 105 forces the SEC to do a rule updating the definition of investment contact to require an agreement and profits.

This is basically cleaning up Howey. 19

Section 106 makes clear this act doesn’t harm SEC’s plenary power to issue exemptions under its existing laws.

Section 107 makes SEC have to consider “ innovation” in perusing its mission.

Section 108 allows SEC registrants to use distributed ledgers for record keeping. 20

Section 109 requires the SEC to modernize all its existing regulations relevant to crypto (including on custody) within a year (aspirationally). And that’s the end of Title I. We’re halfway through the bill.

Title II covers illicit finance, with 201 mandating Treasury craft a “risk-focused” review process for financial institutions. 21

Section 202 creates a new public-private initiative to combat illicit finance, basically a supercharged version of what FinCEN already does.

17,31K

Johtavat

Rankkaus

Suosikit