Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Turns out that there was indeed a disturbance in the force -- the global balance of payments that is -- back when China changed its balance of payments methodology in 21/22 ...

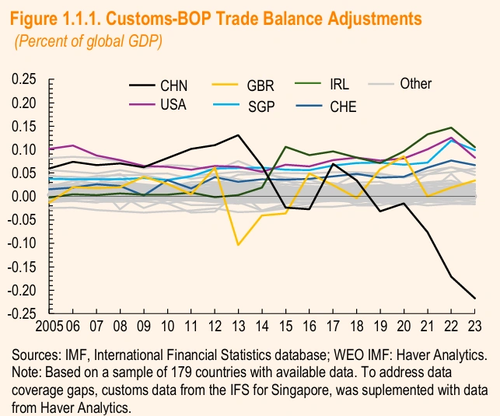

(see the black line in first figure in the first box in the IMF's ESR)

1/

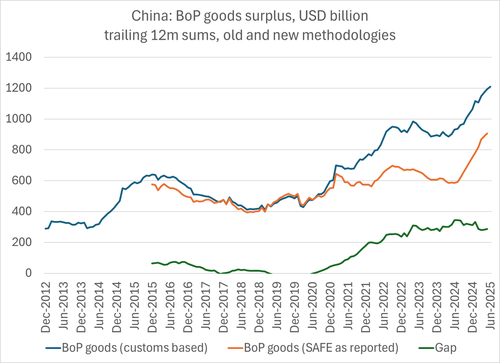

That disturbance -- which I felt, and so did Logan Wright and Adam Wolfe -- came as China used a new internal data set (then undisclosed) to adjust its exports down and move its imports up (relative to its previous methodology, note the fit v the old data before 2020)

2/

The net result was a downward adjustment in China's BoP goods surplus (and its overall current account surplus) that topped $300 billion (1.5 pp of GDP) for a while ...

3/

There were other disturbances in the force as well --

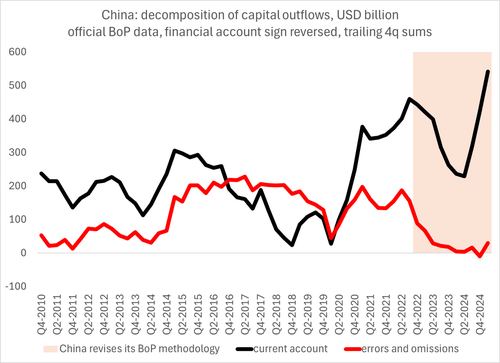

The downward adjustment to the current account led errors and omissions (hot money outflows from China) to disappear even as the PBOC lowered CNY rates below USD rates

4/

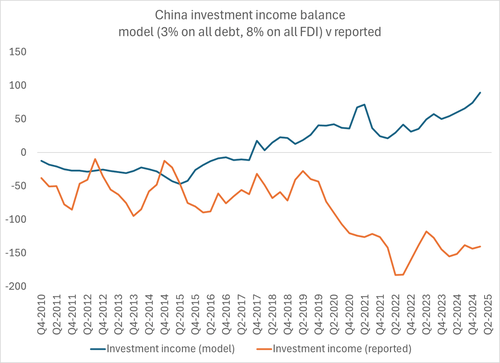

And particularly acute observers (including the IMF) were concerned that China's reported income deficit seemed to grow even as US rates increased and China's net foreign asset position improved ...

5/

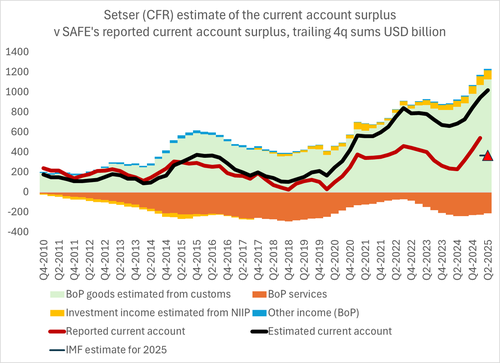

If the current account surplus is computed using China's pre-2021 balance of payments methodology for goods (perfect backfit) and a 3% return on loans/ bonds and a 8% return on FDI (both ways), China's current account surplus now could be $1 trillion ...

6/

The IMF is starting too look at these questions -- kudos.

But it still has a ways to go. The Fund's $365 billion 2025 current account surplus forecast is now dated, but it also reflects some analytic limits in the IMF's current approach ...

7/

Tariff deals take up all the oxygen ... though I suspect the tariff deals will be fleeting (Trump Always Renegotiates -- TAR) while debates about the balance of payments and the IMF's core models are enduring

8/8

PS for the income balance I used a super simple model with constant returns on debt and FDI. SAFE reported that its decade average return for the 10s was 3% by the way. Easy to replicate. But I also have a more sophisticated model -- either way the break comes in 2020

15,7K

Johtavat

Rankkaus

Suosikit