Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Seems as though the DAT phenomenon is quite divisive, wanted to share some thoughts on why we thought this was a worthwhile pursuit:

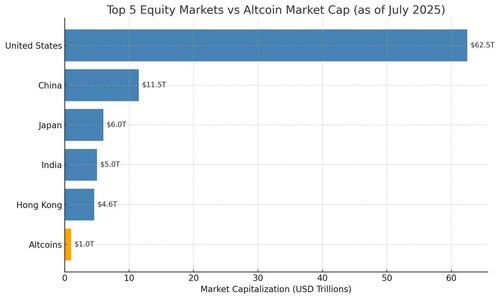

One concern of mine is that we have simply run out of crypto-native capital to bid alts beyond prior cycle peaks. If we look at total alt notional market cap peak in Q4'21 and Q4'24 it tops out at roughly the same number: just under $1.2 trillion. Adjusted for inflation its almost the exact same number between cycles. Perhaps this is how much retail capital there is in the world to bid what is 99% vapourware?

But for tokens with real businesses, producing real products, generating real revenue for real users there is an enormous untapped opportunity to broaden access into institutional investors in equity markets. Alt market cap is a rounding error relative to global equity market capitalisation.

The premium to NAV arbitrage is clearly ephemeral and won't sustain indefinitely. Saylor being the one current exception in my view. Why? He has access to unique forms of leverage in his capital structure that you and I don't. I am personally willing to pay more than 1 BTC for access to quasi noncallable and quasi non-liquidatable leverage on BTC.

All we want is to provide easy access and exposure to equity markets that clearly have excess demand for hyper growth businesses operating within the digital dollar and stablecoin space. It has nothing to do with short term premium to NAV arbitrage. It has everything to do with broadening access to enormous untapped pools of capital. A sustained 1.0x NAV with consistent inflows is better than no access at all.

It is no secret Ethena has faced significant challenges with VC unlocks. I know many of you have been through the pain with us. I personally made countless mistakes with fund raising and think about these mistakes daily. Crypto has a severe capital misallocation problem with private VC capital far outweighing liquid capital to sustain token valuations post TGE. This is the diametric opposite to Web2 where private VC capital is a fraction of equity capital markets. We have been searching for a solution. There is no need to reinvent the wheel - the solution has been sitting there for decades. You wanted a solution to the overhang of VC unlocks?

Well this is it.

24.7. klo 00.30

Microstrategy clones buying up locked token supplies from paper-handed funds is one of the best case scenarios for altcoin market structure.

Cleans up supply overhangs, pumps liquidity in the market, and accumulates tokens to a permanent capital vehicle.

Of course this doesn't apply to all shitcoins. The vapourware with zero revenue is still vapourware with zero revenue even when you throw it in an equity wrapper. But I do think this is an incredibly bullish development for a small handful of tokens where TradFi can underwrite a real business model benefitting from secular growth trends. Outside of majors there are maybe 10 of these tokens. I expect they will begin to disperse more clearly from the coins which have zero bid from TradFi.

164,9K

Johtavat

Rankkaus

Suosikit