Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Why is the sub-$5 million seed round shrinking?

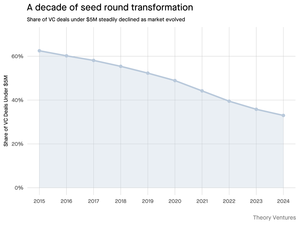

A decade ago, these smaller rounds formed the backbone of startup financing, comprising over 70% of all seed deals. Today, PitchBook data reveals that figure has plummeted to less than half.

The numbers tell a stark story. Sub-$5M deals declined from 62.5% in 2015 to 37.5% in 2024. This 29.5 percentage point drop fundamentally reshaped how startups raise their first institutional capital.

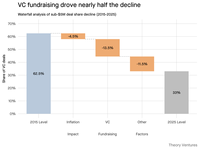

Three forces drove this transformation. We can decompose the decline to understand what reduced the small seed round & why it matters for founders today.

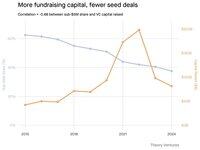

VC fundraising dynamics represent the largest driver, accounting for 46% of the decline. US venture capital fundraising nearly doubled from $42.3B in 2015 to $81.2B in 2024. The correlation of -0.68 between sub-$5M deals & VC fundraising shows a powerful relationship: as funds grew larger, small rounds became scarcer.

Larger funds need larger checks to move the needle. A $500M fund can’t build a portfolio writing $1M checks. The math simply doesn’t work for their economics.

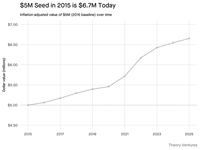

Inflation represents the smallest contributor at just 15% of the decline. What cost $5M in 2015 requires $6.7M today. This represents a meaningful increase but not the primary culprit.

Crucially, BLS data shows software engineering salaries grew at nearly the same rate as general inflation. This means the real cost of building startups remained relatively stable. Salary inflation isn’t driving founders to raise larger rounds.

The remaining 39% stems from other market forces. These likely include heightened competition for deals, increased pre-seed valuations pushing up seed round sizes, & founders’ growing capital appetites as they chase more ambitious visions from day one. The proliferation of seed funds & the emergence of multi-stage firms investing earlier also contribute to this shift.

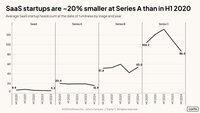

Here’s the paradox : despite these larger rounds, startups are actually shrinking. Carta data shows SaaS companies are 20% smaller at Series A today than in H1 2020. Smaller teams are more than offsetting inflation costs through increased productivity.

This efficiency gain will accelerate with AI. As productivity tools enable founders to build more with less, we’ll see teams generate more ARR per employee while valuations continue to climb. The best founders are already achieving with five engineers what previously required twenty.

We’re witnessing a shift in startup financing. The small, disciplined seed round that launched thousands of companies in the past decade has been replaced by bigger rounds, higher valuations, compressed timelines, & loftier expansion expectations.

4,21K

Johtavat

Rankkaus

Suosikit