Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

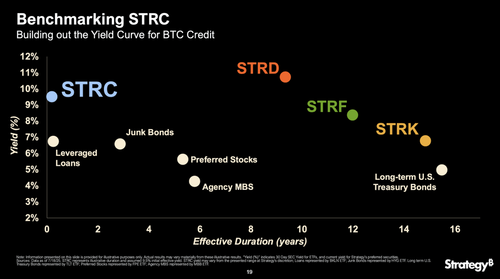

Michael Saylor launched his fourth series of preferred shares $STRC and claims he's "building out the yield curve for BTC credit."

There's one problem: Bitcoin has no yield and offers no credit.

@saylor is calling four preferred shares "the yield curve for $BTC credit"... 🧵

Saylor's "yield curve" is aspirational.

Real yield curves graph the same instrument over different time periods.

He graphs different instruments entirely - various preferreds, not bonds - and conveniently excludes @Strategy's actual bond yields from the chart.

The supposed curve shows investors pricing $STRF shares at just 340 basis points above 20-year Treasuries.

Are we to believe investors give up "the full faith and credit of the US government" for an extra 3.4% yield on MicroStrategy preferreds?

Saylor's curve is inverted (down and to the right) and he mixes short-term junk bonds yielding 6-7% with long-term Treasuries at 4.9%.

A real yield curve only varies by time, not by completely different instrument types and credit qualities.

Bitcoin is an asset that transacts on a blockchain.

Calling 4 preferred shares of a company "the yield curve for BTC credit" is what the article calls "aspirational and confusing."

Saylor is creating financial instruments, not a $BTC credit curve ⤵️

23.7. klo 03.18

Michael Saylor says bitcoin credit now has a yield curve — thanks to him

8,9K

Johtavat

Rankkaus

Suosikit